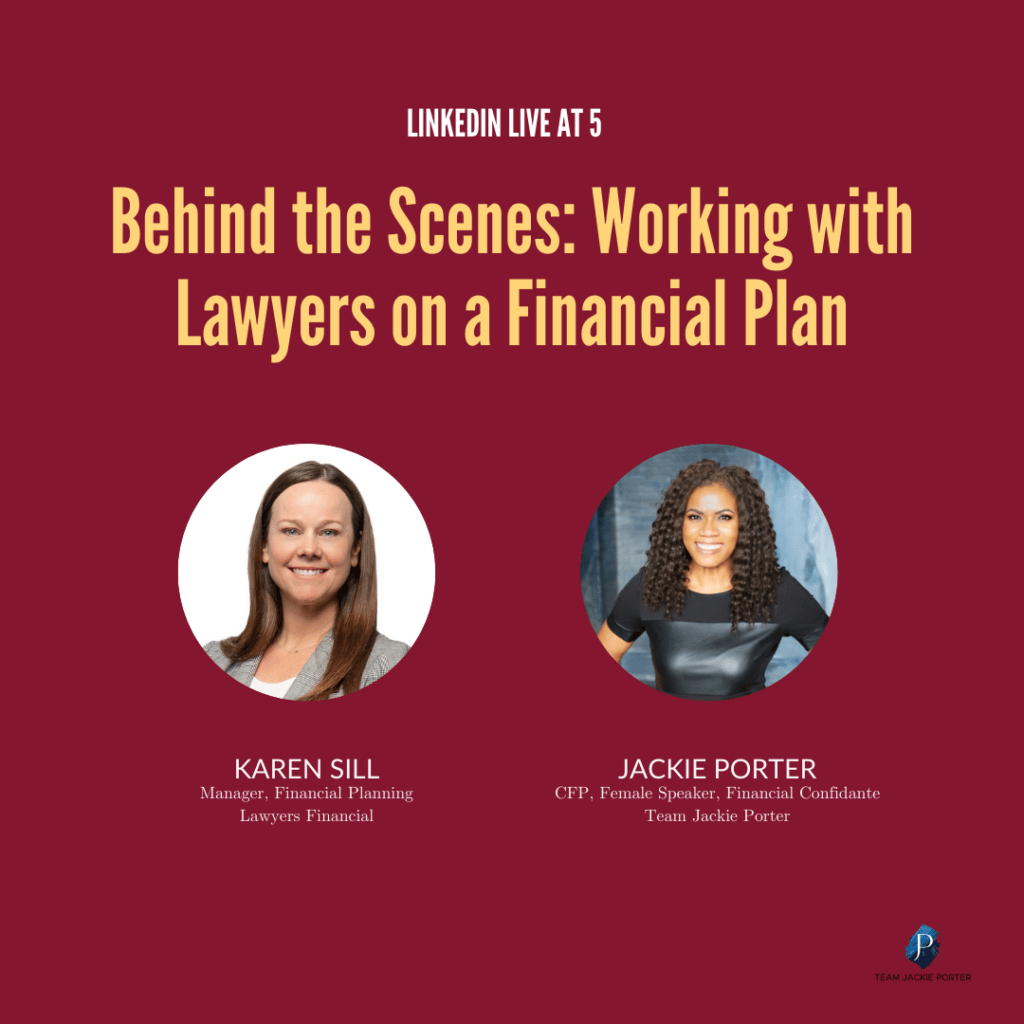

Did you know that even after surviving a pandemic and all the stressors that came with it, money management is still the number one cause of stress for most people. To discuss the importance of financial planning for Lawyers we decided to bring Karen Sill from lawyers financial to have another power-packed conversation on why Lawyers in every stage of their career could benefit from building their own financial plan. Karen Sill is the Financial Planning Manager at Lawyers Financial. She has spent 20+ years designing financial plans for medical professionals. She covers topics that range from cash flow and debt management to investments, retirement & estate planning.

Her role at Lawyers Financial is to help advisors like Jackie support lawyers in meeting and exceeding their goals by working through the financial planning process and creating a roadmap with recommendations for their financial success. If you are a lawyer, read on, as this is a conversation you should not miss so let’s get into it!

Why do you think planning has become so popular?

Karen mentioned that the pandemic made a lot of people sit back and think about priorities they want to focus on in life. With the hectic pace that a Lawyers career can move at, it important that find an advisor they can trust enough to handle their finances, should they decide this is not an area they feel comfortable to handle on their own. Having peace of mind to know their finances are being looked after offers them the freedom to focus on other things. In fact, now more than ever, as interest rates and inflation begin to climb, and the economy becomes more uncertain, there are more lawyers seeking help with their finances.

What can lawyers expect when they go through the planning process?

The financial process has 6 steps; gathering information, establishing goals and objectives, assessing the financial situation, developing and presenting a plan, implementing the plan, and then monitoring and reviewing it.

So, a lawyer should expect an in-depth discovery around personal goals for Karen and her team to provide an accurate picture of their financial circumstances. All 6 components will be covered in detail in a series of meetings where they will focus on a lawyers financial priorities, cashflow, current and future tax bill, risk, investment and estate plan.

How Long Does it Take to Build A Financial Plan?

It takes about 2-3 weeks after receipt of information to get back a financial plan from our team.

What are some common challenges lawyers face at the beginning of their careers?

Law school is not an inexpensive endeavor. Many new coming out of law school face a large debt coming out of law school not that is dissimilar to a mortgage payment. After law school, there are lots of factors that come into play when tackling their debts. These factors vary based on the area of law they choose to practice in, and what they will earn as a base salary. It also gets interesting at this point because some lawyers may want to buy a home at this stage. Figuring out how to best allocate their resources is a major goal for new lawyers so they can live well today and create a nest egg for the future. One thing we don’t leave out of any financial plan is setting aside cash for wellness activities like a vacation! Super important even if it’s just a 2-day getaway. Achieving a balance between short- and long-term goals is key.

What are some of the unique challenges that lawyers go through at the mid-stage of their career?

At this point a lawyer may have more cash flow but they may also have started a family and may be concerned about paying off their mortgage. They may also worry whether they will have enough for retirement, which means they have competing priorities for what to do with their cashflow. Recognizing that cash flow is the driving force of any financial plan, maximizing cashflow, and choosing the right investments based on their risk tolerance to ensure goals are met will be an important goal at this time. Lawyers may also be thinking about their children’s education, in terms of what it will cost, and what programs are available to pay for schooling. They want a plan to ensure that their children’s education will be taken care of.

What unique challenges do lawyers face as they Edge closer to retirement?

A major question for lawyers close to retirement is can I afford to retire? Doing the math and figuring out how much their lifestyle will cost them and using conservative numbers to estimate how much they will earn on their investments will provide valuable information for lawyers looking to build a sustainable retirement plan. Lawyers also want a better understanding of the resources they will have to draw on, and how and when they should start taking money out of their various financial buckets. Some others are just starting to think about how they will spend their time in retirement after dedicating their lives to the law. Looking at strategies to minimize the taxes on nest egg they have created for themselves, and their heirs is crucial.

What advice can you offer a lawyer who is still putting off dealing with their finances and taking advantage of the free financial plan?

To encourage lawyers to take advantage of a financial plan early enough, Karen’s first advice is that people shouldn’t be afraid to do a financial plan because it may add value to you by providing insight on your current circumstances. You have nothing to lose and potentially a lot to gain if you take advantage of a complimentary financial plan offered exclusively to lawyers, by an organization who advocates for the legal community!

If you would like to discuss this opportunity further, reach out to us at info@askjackie.ca.

More Financial News & Events

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb

Financial Conversations Couples Need To Have at Different Life Stages

Feb

Disruption and Reinvention: Starting a Second Career in your Forties

Jan

How to create a strong financial fortress during market downturns

Jan

Creating a Financial Vision Board for 2023

Jan

5 Tips to set yourself up For Financial Success in 2023

Jan

Year-end Donation strategies

Dec

Year-end tax planning

Dec

Getting clients organized for 2023

Combating Quiet Spending

Nov