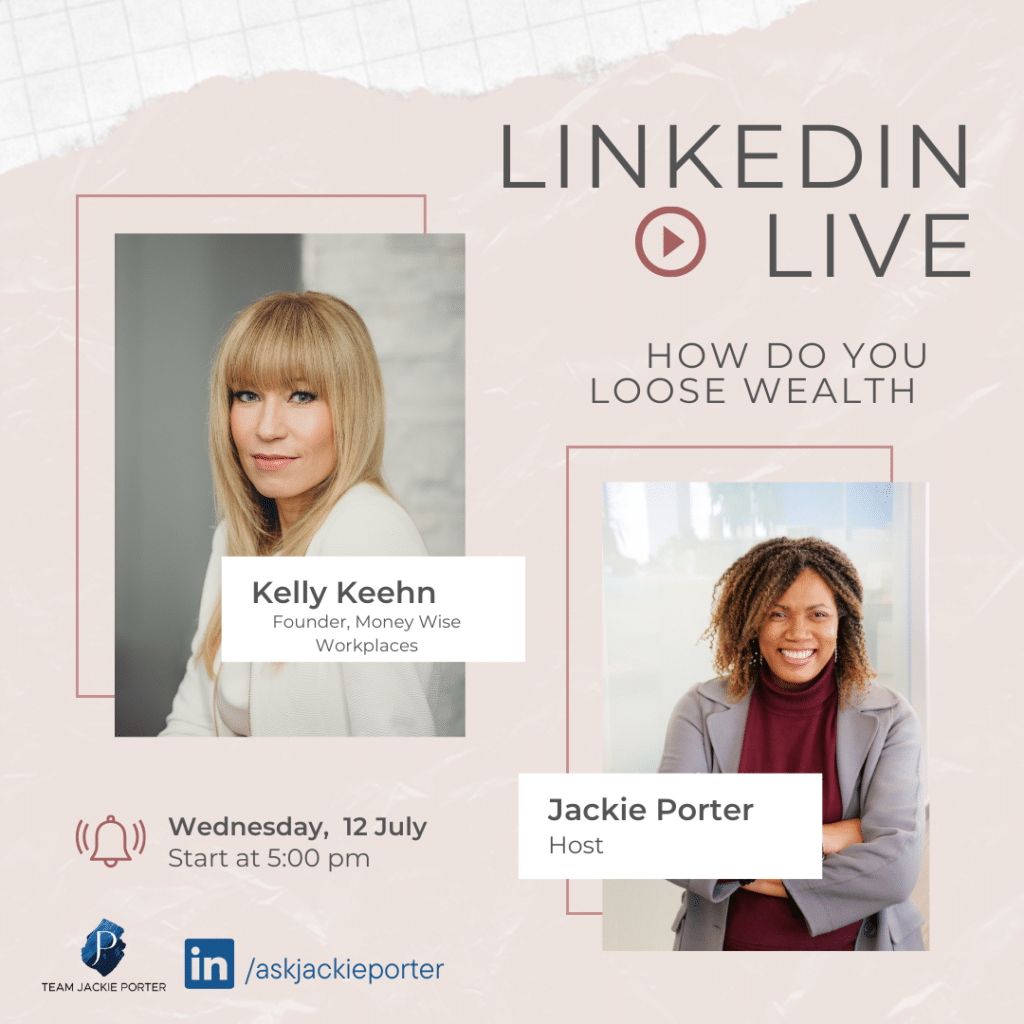

In this episode of Live at Five with the Financial Confidante, Jackie is joined by Kelley Keehn, to discuss the topic of losing wealth. Inspired by Annie Lennox’s song “Here Comes the Rain Again,” they delve into the reasons why individuals may face financial setbacks and the lessons that can be learned from such experiences. Kelly Keehn, a renowned financial expert and founder of MoneyWise Workplaces, shares insights on minimizing the dangers of losing wealth and making sound financial decisions in challenging times.

The Mindset of Losing Wealth

Jackie and Kelly start by discussing the mindset associated with losing wealth where they highlight the concept of the upper limit theory, this happens when individuals set subconscious limits on their level of happiness and financial success. They emphasize that one’s mindset about money plays a crucial role in determining how they handle wealth. If someone is accustomed to a hand-to-mouth existence, they may find it difficult to break free from that financial ceiling, regardless of their financial situation.

Factors Contributing to Wealth Loss

Kelley explains that taking risks without understanding the potential consequences is one of the factors that can lead to losing wealth. She cautions against underestimating the hard work and dedication required to accumulate wealth, highlighting the importance of patience and perseverance. Additionally, she raises concerns about the influence of social media, which can create a false perception that wealth creation is effortless. In reality, building wealth takes time, discipline, and a deep understanding of financial principles.

The discussion touches on the emotional aspect of losing wealth. Jackie and Kelley discuss how fear and anxiety can lead individuals to make impulsive financial decisions. They emphasize the importance of staying grounded and making rational choices rather than succumbing to emotions during times of financial stress. Kelly shares the story of lottery winners who, due to emotional decisions and a lack of financial education, ended up losing substantial amounts of money.

Shifting Financial Mindset

A financial mindset shift is important to avoid falling back into old patterns of financial struggle. Kelley shed some light on the importance of recognizing that wealth creation is not an overnight process and that setbacks are a part of the journey. By embracing a growth mindset and understanding the long-term perspective, individuals can bounce back from financial challenges and work towards regaining their wealth.

They highlight the significance of perceiving all money as one’s own, regardless of its source. They discuss individuals’ tendency to treat certain money pots, such as inheritances or bonuses, differently and often recklessly.

The Power of Conversations

Kelley emphasized the central role emotions play in shaping our financial behaviours. From impulsive gambling to making gut decisions driven by market fluctuations, our feelings often overshadow rational thinking. She encourages individuals to engage in conversations that explore the complexities of financial decision-making and uncover strategies for overcoming emotional biases.

Seeking Professional Guidance

According to Keehn, seeking professional help is crucial in regaining control over our financial decision-making processes. By consulting financial planners and advisors, individuals can gain valuable insights, identify blind spots, and receive guidance tailored to their specific needs. Keehn stresses the importance of finding trustworthy professionals who can offer reliable advice and support during challenging times.

Striking a Balance: Risk vs. Reward

Finding the balance between risk and reward is a key aspect of financial decision-making. Keehn recommends conducting simulations and worst-case scenario analyses with financial advisors to understand the potential outcomes of different investment choices. By comprehending the risks involved and aligning them with personal financial goals, individuals can make more informed decisions and manage their expectations effectively.

Building a Relationship with Your Future Self

To counteract short-term thinking and impulsive behaviours, Keehn encourages individuals to develop a strong connection with their future selves. By envisioning the person they aspire to become and aligning their financial decisions with long-term goals, individuals can reinforce the importance of delayed gratification and make choices that support their future financial well-being.

Any final advice for people looking to build wealth?

For those who have experienced financial setbacks or losses, Keehn highlights the significance of recognizing that these setbacks are not always within their control. It is crucial to seek professional help, take action, and avoid dwelling on past losses. By focusing on the future and adopting a forward-looking mindset, individuals can rebuild their financial confidence and regain control over their financial management.

Kelley Keehn can be reached at https://kelleykeehn.com/ for all things money savvy, tips for navigating your personal finances. Be sure to reach out to our team at jody.euloth@askjackie.ca to start having a conversation about managing your financial fortress and how our team of experts can give you a factual picture of what your financial future could look like.

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb