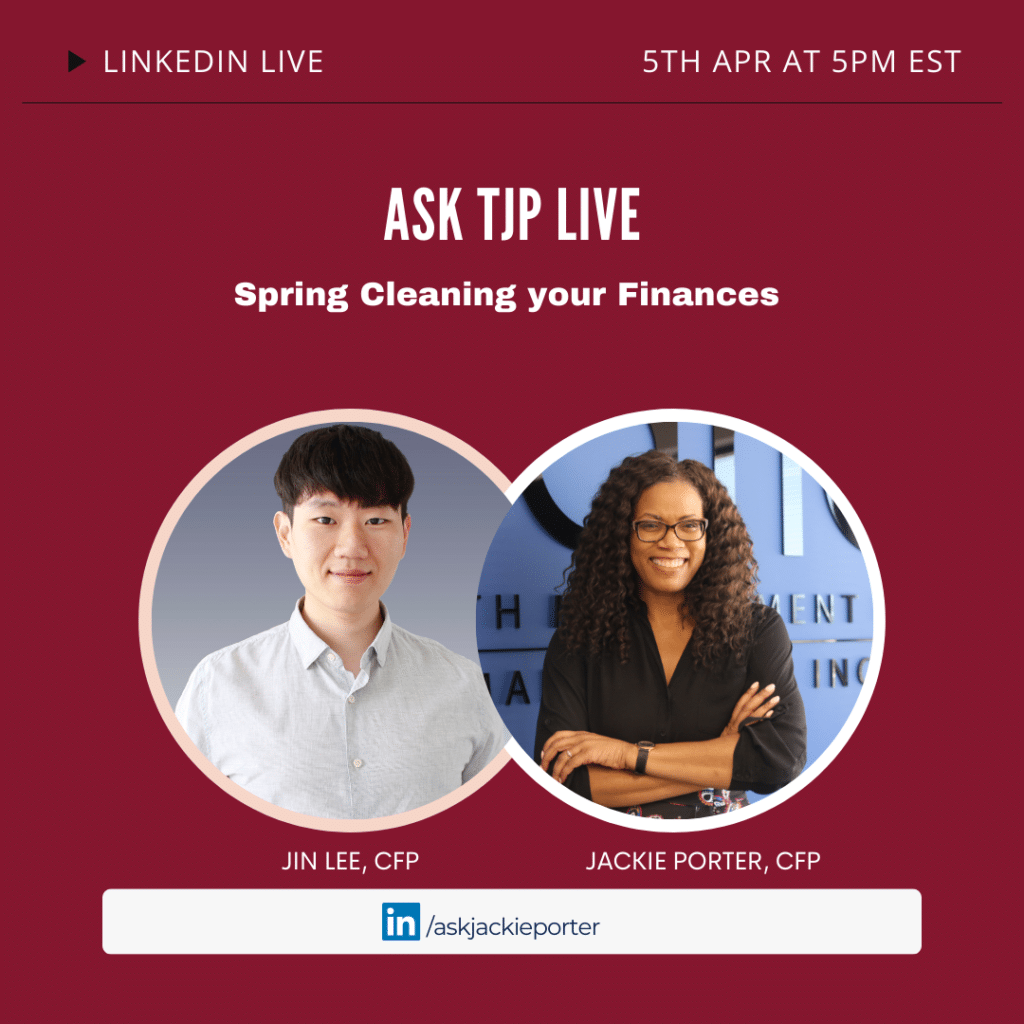

Welcome to the month of April live community! This week Jackie and Jin are back to give us tips for spring cleaning your finances. If you are feeling like your finances have been in free fall since coming into this time of high interest rates and inflation, stay tuned for our spring cleaning tips and hacks.

Are you staying on top of your financial statements? What about your credit card reports and bank statements that are piling up? It’s time to get organized and refresh your finances so let’s dive into the conversation.

Reviewing your budget

Budgeting may not be the most fun activity but when you do it and follow through, there is this fulfilling feeling you get from knowing that you managed your finances as you planned and can achieve more in the coming years. There are a lot of budgeting apps you can use to start that help you see where to reduce your budget and where you need to give yourself more room for unexpected expenses. DM us to get our list of the top budget apps for 2023 or if you need a copy of our budget template. If you are retired, a budget gives you a level of confidence that your money will last you throughout your retirement.

Planning for major one-time expenses

You want to make room for financial emergencies that come up out of nowhere such as an expensive car or home repair bill. Factor these expenses in your monthly budget by setting aside specific amount each month so you have a cushion to draw on instead of having to going in to debt.

Cleaning up your bank accounts and credit cards

Speaking of debt, do you have multiple accounts and credit cards, how often do you check the fine print on your accounts? Do you pay banking and credit card fees each month? Do you feel overwhelmed because of too many accounts to keep track of? The hack is to simplify as much as you can! Multiple bank accounts make things stressful and costly. PC Financial has a new banking system which gives you optimum points on all the bills you pay using their no fee bank account and PC financial credit cards. Go into spring cleaning with your eyes wide open and monitor where all your money is going and what benefits you are getting banking with your financial institution. Consider a no fee banking solution that gives you points you can use toward everyday expenses. Look at the big picture and where you need to be by simplifying and consolidating your money!

Let’s talk about your credit score

How often do you check your credit report? A good rule of thumb is to check on your credit score once a year. You want to be sure you are still on track with a good report and there are no fraud discrepancies in your report you might not be aware of. Check out websites like Borrow Well and Credit Karma where you get access to regular monitoring of your credit score.

Let’s talk about investments

How often do you check your investments? We suggest doing so annually to see how your investments are doing. Checking every day or month may be too often as a month does not reflect a long time in the market. However, checking annually and comparing with how the markets you are invested in are doing is an important benchmark. You should also review annually to see if your investments are still aligned with your long-term financial goals. As you get closer to retirement, you want to be more conservative with investments since you will now likely be living off your assets.

Building your insurance coverage

After looking around and cleaning up, you want to investigate your insurance plans. The question to ask yourself is if your circumstances have changed, did you just acquire a new property? Have a new baby? As your dependents increase, you want to look at your insurance coverage to make sure it is still sufficient. With layoffs now becoming rampant, you should revisit your coverage if you lose a job and are left without any disability coverage. Risk planning and insurance changes over time and the best you can do is to make sure your needs keep up with the coverage you have in place.

Lastly, we understand that organizing and managing your finances can be challenging for some people. We are here for you! Feel free to comment on this live if you have specific questions about your own circumstances. Reach out to our client experience manager jody.euloth@askjackie.ca to book a 30-minute complimentary strategy session today. At the end of the day, it’s all about working with someone you feel comfortable with, and you trust. We hope that’s us. FP Canada has a directory of certified financial planners that specializes in different areas of planning and is a good resource to check if you want to work with a professional planner. Thanks for Checking out our blog and feel free to share you biggest spring-cleaning challenge in the comments.

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb