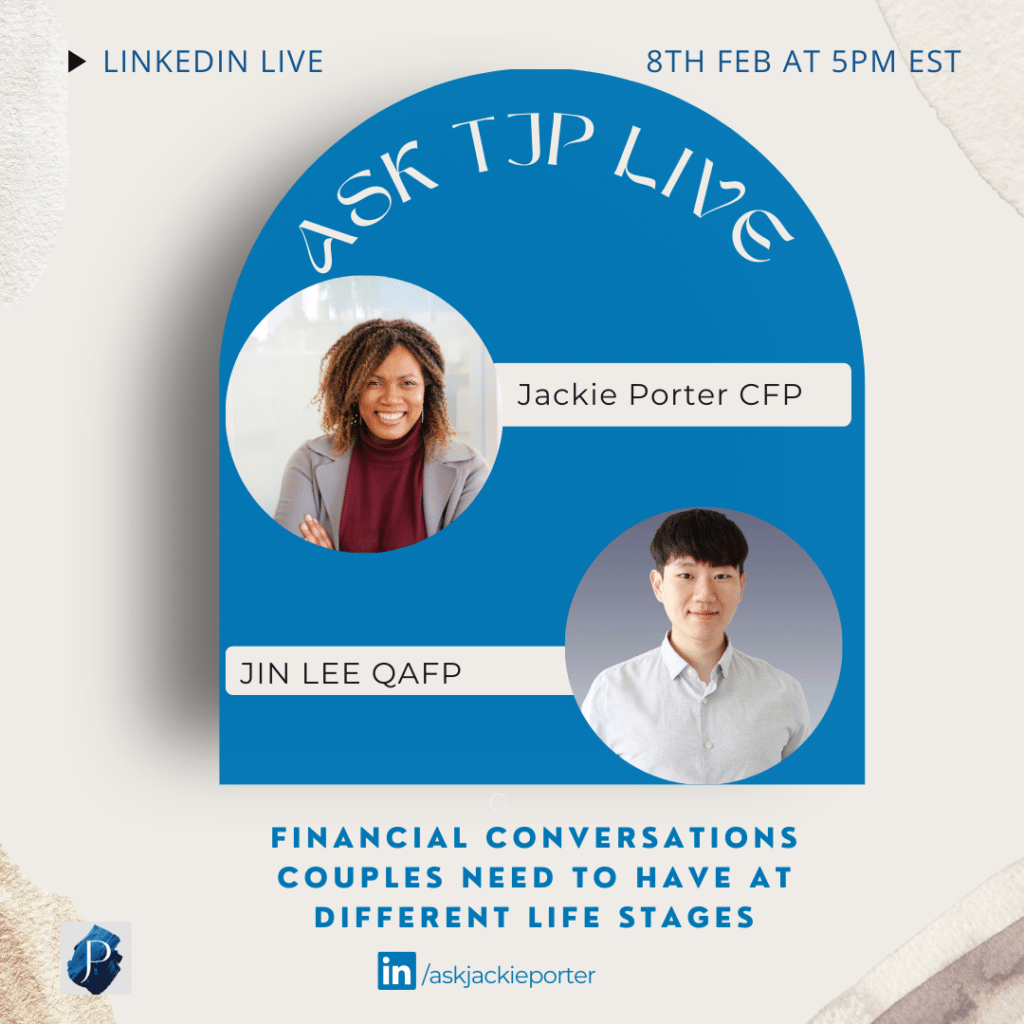

Jin and Jackie are back this week to discuss Financial Conversations Couples Need To Have at Different Life Stages. Financial conversations amongst partners is crucial to the success of any relationship and here’s a recap of all the tips they shared.

What kind of financial conversations should people be having at the beginning of a relationship?

At that stage it can be challenging to have financial conversation but it should not be skipped. Having these conversations will help couples get to know themselves even better and in no time build the relationship. Having money conversations on the first date.. maybe not! But you should definitely have them whilst in the honeymoon phase.

Pro tip: instead of having the conversation directly so it does not look like you are probing your partner, consider sliding in some money question while having light ‘get to know’ games.

Can people really feel comfortable having money conversations?

The truth is, if you try to have money talks with a potential life partner and you don’t get anything back, consider that a potential red flag. Jackie and Jin who are financial advisors say that they are not just undatable but financially undateable! So put it in your list of qualities to look out for when dating. There will be so many ‘uncomfortable’ financial conversations in one’s life time and starting from the beginning will help build great financial habits for the relationship. Remember to be transparent and think about whether you are financially compatible as well as emotionally compatible.

Rare advice: consider getting financially naked just before you decide to get intimate!

Let’s talk about moving in together!

Now that you have gone through the early stages and had these conversations, you have decided you are going to move in together. The first thing to consider is how will the bills be split up? How much is each partner making? Will it be a 50/50 split? Financial equity in a relationship is a real thing that causes issues and one that needs to be dealt with. Not being financially transparent can cause resentment overtime for couples. Use percentages to figure out who should pay what in order to create financial harmony in the relationship. Jackie’s recommendation when moving in together and considering merging your finances will be for you to have 2 accounts:

- The YOU account – for investments such as RRSPs, personal expenses

- The We account – Joint savings, vacations, joint expenses

When it comes to joint accounts, it’s also a great idea to use joint accounts for those shared expenses. However, you may want to retain your financial identity and privacy with separate accounts for individual expenses and saving such as expenses related to a child from a former relationship. Another reason to create an individual account, is to establish a savings buffer should the relationship not work out and you divorce in the future. Remember more than 50 percent of relationships fail unfortunately! Ensure you lay a great foundation while dating, to ensure you are on the same page when it comes to money values, so if the relationship doesn’t work out, assets brought into the relationship are protected. This conversation is an especially important one, as couples are getting married later and often bringing assets into the relationship. A prenup/cohabitation agreement will allow you to build financial security for yourself and your partner and the bonus is if you have had those crucial money conversations before you move in, then it will be an easier to have the pre-nup conversation.

Getting a third-party expert opinion might be useful to take off some of the pressure of having the conversation on your own. Work with a financial planner if you are ready to have a money conversation with your partner, and need help figuring out how you can get on the same page. The planner is there to support the couple in meeting its financial goals so its all about striking a balance for the good of everyone involved.

If you need support as you navigate a new relationship and wondering how to start having these financial conversations, reach out to jody.euloth@askjackie.ca. Also, feel free to share your questions with us here or on our social platforms

More Financial News & Events

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb

Financial Conversations Couples Need To Have at Different Life Stages

Feb

Disruption and Reinvention: Starting a Second Career in your Forties

Jan

How to create a strong financial fortress during market downturns

Jan

Creating a Financial Vision Board for 2023

Jan

5 Tips to set yourself up For Financial Success in 2023

Jan

Year-end Donation strategies

Dec

Year-end tax planning

Dec

Getting clients organized for 2023

Combating Quiet Spending

Nov