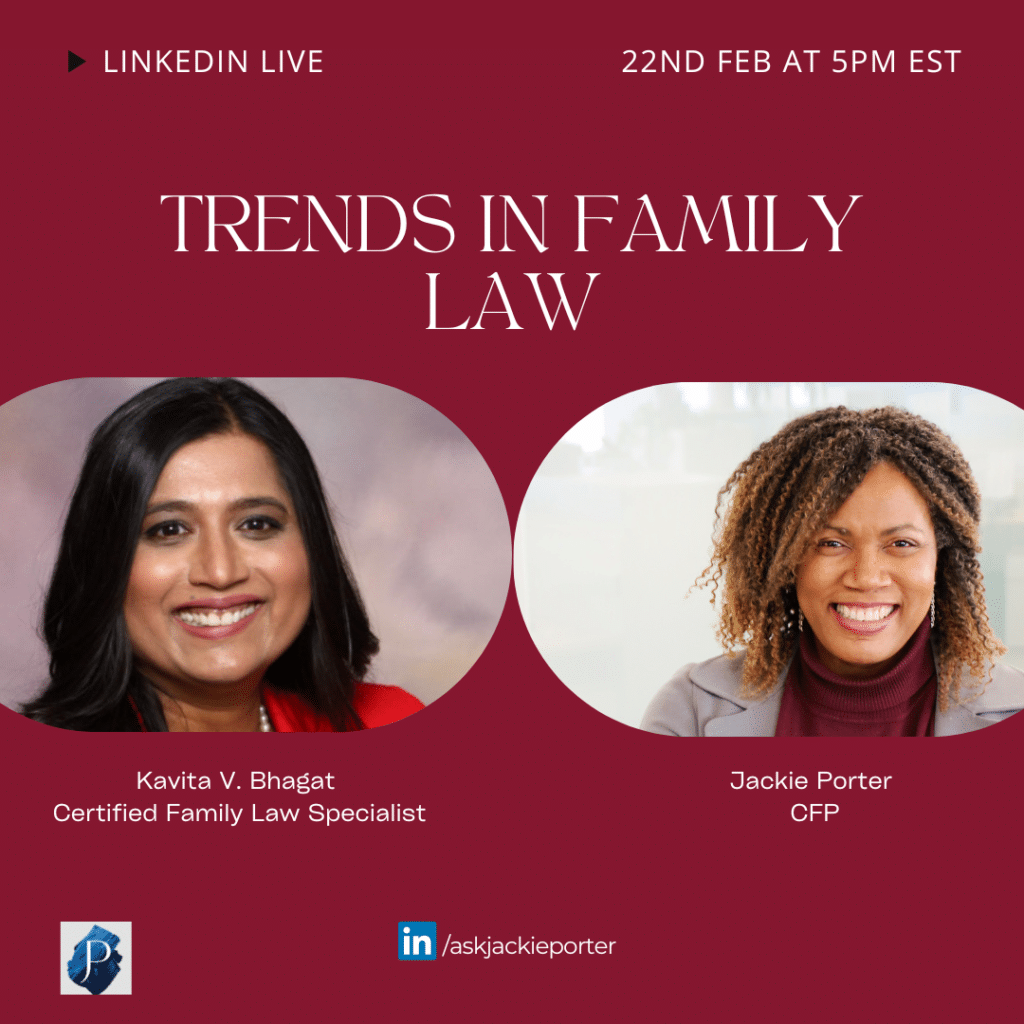

Jackie is back with Kavita Bhagat, Certified Family Law Specialist, to discuss trends in family law as we wrap up the love and money series for the month of Lovuary! In this episode of Live at 5 with the Financial Confidante, they talk about how couples are consciously uncoupling post pandemic and what the implications are on their finances. Turns out a lot of couples went their separate ways during the pandemic for so many different reasons. Let’s dive into the conversation.

There are so many issues that arise from being in a common law relationship that people do not even realize. It’s important to be aware of these loopholes in case the relationship we are in does not work in the future. Maybe getting a co-habitation agreement is what could potentially save you serious financial pain in the future. Remember that the law is the law and it is sometimes not fair. Consider protecting your assets when getting into a serious relationship instead of going into it blindly without consulting a family law specialist.

Was there any rhyme or reason as to why relationships ended during the pandemic?

As much as covid tested relationships to the max, it was not necessarily because of time spent but the time many people got to figure out what they wanted to do moving forward. Also, both genders got a chance to be involved in childcare even if it was circumstantial for some men who were now working from home because of lockdowns. Typically the high income earners who were typically male are now filing for shared parenting in separation, simply because they have more opportunity to continue to work remotely. That does not mean they are putting in the same amount of work as the primary caregiver, yet it will impact what they would be obligated to pay for child support. These nuances are amplified when immigrants are involved as there are sponsorship details that might be missed out and could cost one partner more, or cost the other partner access to additional monthly support at the point of separation.

What are some challenges you have seen over the last couple of years as people separate?

The biggest issue will be the lack of understanding of finances. Take for example, when a couple who owns a house together go their separate ways and one party decides to keep the home, they don’t realize that it affects their credit profile in the sense that child and family support is also being factored into their monthly obligations, while their assets are considered to be 50 percent less. This may lead the the lender to deem them unfit to continue financing the property on their own. Also, if they are a real estate investor, the investments they made as a couple are now being split in two as well, this causes a huge gap between what people think their financial situation will be after a separation vs what the reality is.

Separation tends to put a strain on co-parenting in the sense that, if one parent can barely afford to match their old lifestyle the children could potentially suffer and the second parent may

not be able to afford to live nearby. Parents just need to work together in most cases to salvage the situation from a financial standpoint to avoid huge losses. The most important thing is to consider getting a financial professional come to educate you on what is financially feasible for both parties and not let your emotions get the best of you as you negotiate the separation.

What advice do you gave for people going through a separation?

You must think of it as a business proposal! It is very important that you treat your separation process as a business transaction and consult the services of a financial planner, lawyer and accountant based on your situation so that you maximize the assets you and your partner can take with you as you leave the relationship. Build a team that can help you and do not leave anything to chance!

Are you going through a divorce? Talk to Kavita Bhagat on LinkedIn. If you need support on getting important financial questions answered we are happy to help! Pease reach out to jody.euloth@askjackie.ca. Also, feel free to share your questions/experiences with us here or on our social platforms #valentines #separation #cohabitationagreements #askjackie

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb