In this episode of Live at Five with the Financial Confidant, Jackie delves into pressing financial matters such as mortgages, interest rates, high inflation, and retirement. With a focus on making financial conversations accessible, Jackie shares insights that resonate with the concerns many Canadians face today.

Unraveling Mortgage Mysteries

Have you recently checked your variable interest mortgage statement only to find the amortization date labeled as “unknown”? Jackie narrates a client’s experience, shedding light on how rising interest rates can throw amortization dates into uncertainty. This situation has become increasingly common, leaving many Canadians anxious about their financial future.

Jackie discusses the challenges posed by high inflation, soaring interest rates, and the strain on households managing home-related expenses while planning for retirement. The conversation sets the stage for a deeper exploration of potential solutions.

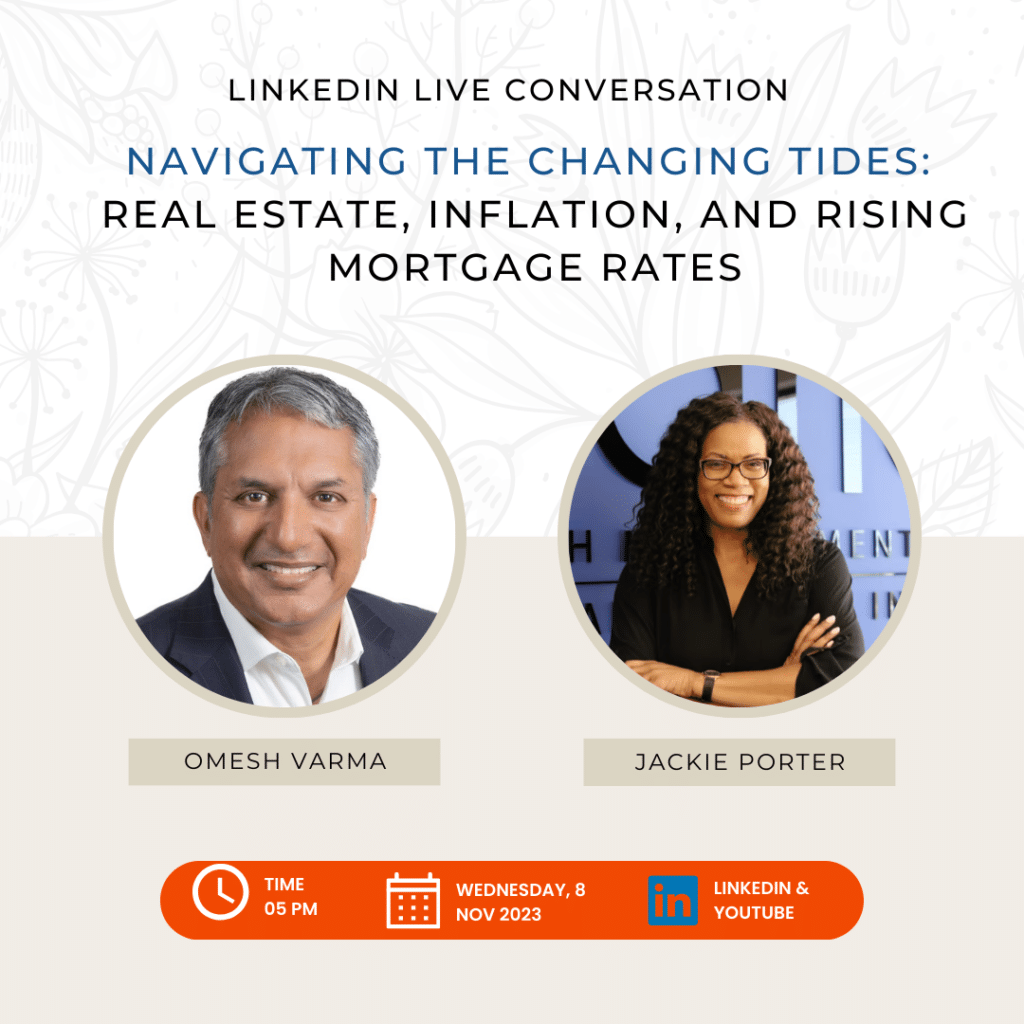

Meet Omesh Varma: The Reverse Mortgage Expert

Welcoming Omesh Varma from Home Equity Bank, the provider of CHIP reverse mortgages, Jackie introduces a key solution to the financial challenges many retirees face. Omesh sheds light on Home Equity Bank’s unique position as a federally regulated bank specializing in reverse mortgages and GICs.

Demystifying Reverse Mortgages

Omesh shares insights into the changing landscape of reverse mortgages and the role Home Equity Bank plays in providing financial solutions. The conversation touches on the strategic move by the Ontario Teachers Pension Plan to acquire the bank, emphasizing the evolving perception of reverse mortgages in the media.

The Shifting Perspective on Home Equity

As the discussion unfolds, Jackie and Omesh explore how financial planners are increasingly integrating home equity into comprehensive financial plans. The conversation challenges the conventional view of homes as separate assets, emphasizing the need for a holistic approach to financial planning.

Trigger Rates and Extended Amortization

The episode delves into the alarming trend of trigger rates and the extension of amortization periods by major banks. Jackie and Omesh share statistics indicating a significant percentage of mortgages exceeding 35 years, highlighting the financial challenges faced by homeowners.

Navigating Short-Term Pain for Long-Term Gain

Addressing the current economic climate, Omesh provides insights into the potential trajectory of interest rates. He suggests that short-term financial pain may lead to long-term relief, with projections indicating a stabilization and eventual decrease in interest rates.

Reverse Mortgages: A Modern Financial Tool

Transitioning into the second part of the conversation, Omesh dispels misconceptions surrounding reverse mortgages. He emphasizes that Home Equity Bank’s CHIP reverse mortgage is a modern financial tool that allows individuals to tap into their home equity without making monthly interest payments.

The Impact of CHIPP Reverse Mortgages

Jackie delves into the operational aspects of CHIP reverse mortgages, exploring scenarios where individuals can use the proceeds to pay off existing mortgages, freeing up cash flow. Omesh emphasizes that the CHIP reverse mortgage is designed to replace traditional mortgages without the burden of monthly payments.

Residual Equity and the Myth of “Giving Away” Homes

Omesh tackles the common fear associated with reverse mortgages—the misconception that homeowners are “giving away” their homes. He shares data indicating that, on average, individuals retain over 60% of residual equity even after utilizing a reverse mortgage for a decade.

The Changing Dynamics: Bank of Mom and Dad

The conversation takes an intriguing turn as Omesh discusses a contemporary trend—parents leveraging reverse mortgages to support their children financially. He shares anecdotes of parents using reverse mortgage funds to assist with down payments and other financial needs, redefining the concept of family financial support.

Making Informed Financial Decisions

In the final segment, Omesh offers advice to those hesitant about reverse mortgages. He encourages individuals to consider their unique financial situations, emphasizing the flexibility and potential benefits of CHIPP reverse mortgages. The conversation concludes with a call to action for those navigating financial uncertainties to seek proactive solutions.

For personalized financial guidance and support, you can reach out to our client experience manager at jody.euloth@askjackie.ca.

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb