Welcome to our Wednesday Live and Ask Me Anything series, and Happy New Year! In today’s discussion, we delve into a topic that many of us may encounter in our careers—layoffs. Whether you’ve experienced it firsthand or are curious about how to prepare for the unexpected, you’re in the right place.

Jin emphasizes that facing a layoff can be daunting, but with the right mindset and preparation, individuals can navigate it successfully. This article explores both the mental and financial aspects of preparing for a layoff and how financial planning plays a crucial role in readiness.

Financial Planning for Layoffs

Jackie highlights the significance of financial planning in preparing for potential layoffs. Whether you are currently facing uncertainty in your job or want to be proactive in securing your future, valuable tips and strategies will be shared.

Reading Signs and Being Proactive

Jin suggests starting by being proactive and recognizing signs such as changes in company dynamics, industry shifts, or colleague discussions. It’s essential to be aware and prepared. Jackie shares anecdotes, including a client who experienced a layoff after the company witnessed three declining quarters, reinforcing the importance of reading these signals.

Jin adds that being proactive involves realistic planning. A client expecting a layoff at 55 planned for retirement, ensuring the layoff became an opportunity for exploring new ventures rather than a setback.

Jackie advises considering job stability realistically. Certain industries may offer high pay but lack stability, necessitating a robust plan B.

How to Pay Bills

Jin addresses the scenario of short-term layoff preparation, focusing on two critical questions: How to pay bills, and how will the layoff impact long-term goals like retirement?

Negotiate a Severance Package:

Seeking a lawyer’s assistance, negotiating a favorable severance package, like one year of salary continuance, can provide a financial cushion during the job search.

Employment Insurance (EI):

While EI may not fully replace earnings, it serves as a financial supplement during layoffs.

Emergency Savings:

Emergency savings become a crucial source if severance and EI are insufficient.

Line of Credit (LOC) or TFSA:

Depending on the market conditions, drawing funds from a TFSA may be more advantageous than a line of credit. It’s advisable to secure a line of credit while employed for favorable rates.

Temporary Jobs:

Finding a temporary job is a strategic move to supplement income during the transition period.

Impact on Other Financial Goals

Jackie encourages viewing layoffs as opportunities for new chapters in life. A client working overseas, laid off at 55, found peace of mind in realizing she could retire anytime, offering flexibility in pursuing passions.

Jin emphasizes the importance of understanding illiquid assets, as clients with substantial illiquid assets may not feel wealthy despite being financially secure.

Clients laid off often leverage the situation to pursue passions or new careers. Salary continuance allows for a smoother transition period, and financial planners play a crucial role in scenario analysis and budget adjustments.

Negotiating Severance Packages

Jackie advises against hastily accepting severance packages. Options like salary continuance and maximizing RRSP contributions should be considered for optimal tax benefits.

Seeking Help and Shifting Mindset

Jackie stresses the importance of seeking help when dealing with layoffs. A mindset shift away from self-blame is crucial. This month, the focus is on mindset, exploring ways to turn challenges into opportunities.

In conclusion, combining financial preparedness and a positive mindset equips individuals to navigate layoffs effectively. Proactive financial planning, negotiating severance wisely, and viewing layoffs as opportunities are key strategies to weathering uncertainties. Remember, seeking professional advice during such times is invaluable. If you’re facing financial challenges or contemplating a layoff, connecting with financial experts ensures you start the next chapter of your life on a strong footing. Reach out to us at Jody.euloth@askjackie.ca

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

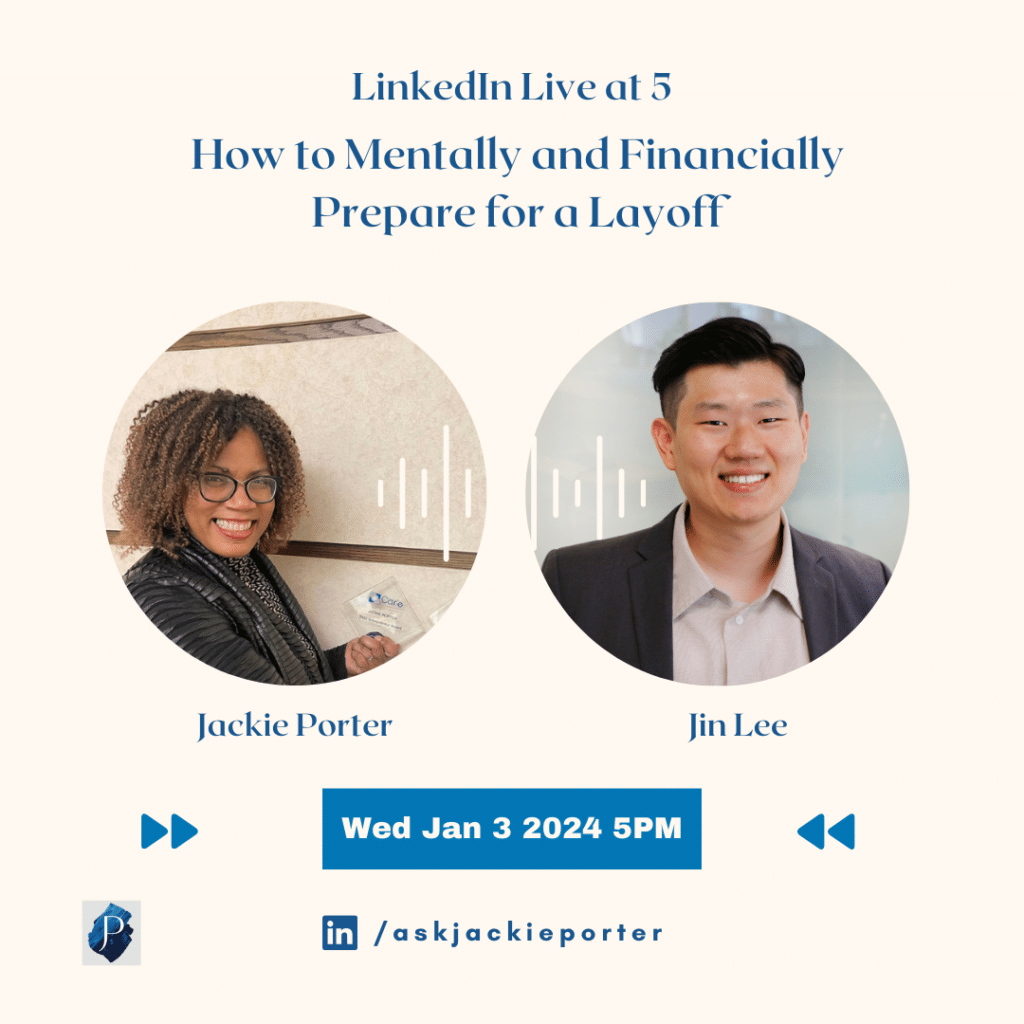

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb