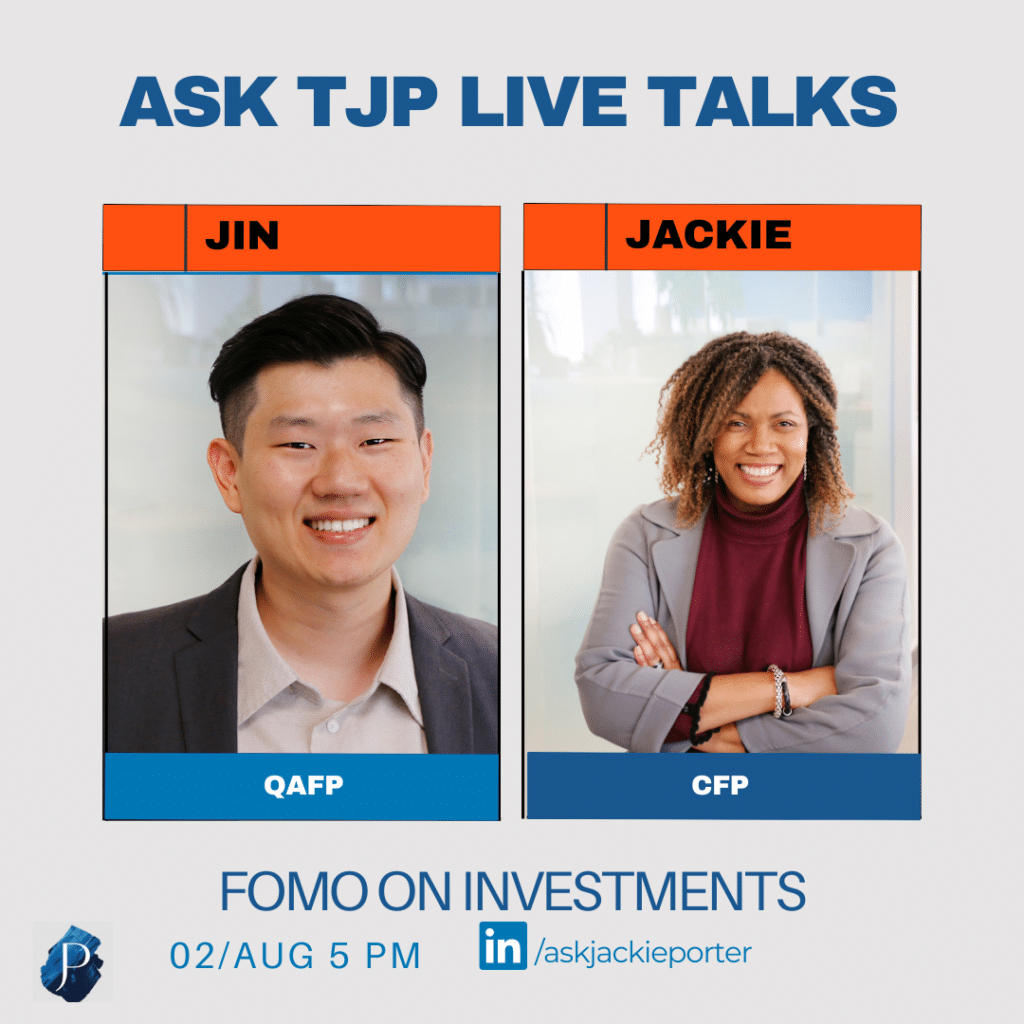

Welcome confidante community to another live session hosted by Jackie Porter, and her co-pilot, Jin. The topic of discussion is “Overcoming FOMO on Investments.” Remember, these interactive sessions are designed to make financial conversations accessible and enjoyable while imparting valuable lessons to our community. They both shared their wealth of knowledge and experiences, providing a holistic understanding of FOMO and its impact on investment decisions.

Understanding FOMO: The Fear of Missing Out

Jackie and Jin began by defining FOMO as the fear of missing out on a seemingly lucrative investment opportunity. They explained how FOMO can be triggered by social influence, making investors feel compelled to jump onto a bandwagon without fully understanding the risks involved. Drawing from their extensive experience, the speakers shared anecdotes of clients who succumbed to FOMO-driven investments and the challenges they faced as a result.

Real-Life Examples: Navigating Bubbles

To underscore the importance of FOMO awareness, Jin presented real-life examples of investment bubbles. They discussed the tech industry boom in 2022, where investors witnessed rapid growth in technology stocks, only to face significant losses when the bubble eventually burst. Similarly, they delved into the historical “Tulip Mania” of the 1600s, highlighting how irrational exuberance led to an inflated tulip market, ultimately resulting in a disastrous crash. These are real life examples of the cycles of bubbles.

The Role of Education and Analysis

To overcome FOMO, Jackie stressed the significance of education and analysis. They encouraged investors to gain a thorough understanding of their investments, assess their risk tolerance, and align their choices with their long-term financial goals. Remember, you can seek professional advice which can be instrumental in making well-informed decisions and avoiding impulsive choices based on external tips and market trends. Reach out to our team at jody.euloth@askjackie.ca to get advice on overcoming FOMO on investments.

Diversification and Sustainable Wealth

Jackie and Jin emphasized diversification as a key strategy to combat FOMO. They emphasized the importance of maintaining a diversified portfolio that balances risk and reward, tailored to each individual’s financial circumstances and objectives. The duo elaborated on the concept of “sustainable wealth,” where the primary focus is on generating consistent, long-term returns rather than chasing short-term gains in the market.

Learning from Past Mistakes

During the session, Jackie highlighted the cyclical nature of markets by exploring past investment bubbles. They discussed the dot-com bubble of the late 1990s, where euphoria surrounding technology stocks led to an eventual crash. Similarly, they revisited the real estate market crash of 2008, underscoring the importance of understanding market cycles and being prepared for potential downturns. A typical market cycle at the beginning of a bubble tends to resemble the euphoria someone may feel when they gamble, excitement- followed by fear around losing money on bet they made- and then disappointment or depression from getting caught up in the moment after going way above their comfort zone, in terms of how much they invested. When making an investment, ask yourself, why are you making the investment in the first place? Is it based on rational or irrational expectations of future returns? Remember the first rule of investing is to check your emotions at the door.

Empowering Investors to Make Informed Choices

We encourage you to develop a well-defined investment philosophy that aligns with your financial objectives and risk tolerance. By staying educated, diversified, and focused on long-term goals, investors can confidently navigate the market and resist the lure of FOMO-driven decisions. We hope we have left you with a deeper understanding of FOMO and the tools necessary to overcome it, setting you on the path to achieving sustainable wealth and financial success. Do you need investment advice and planning? Reach out to our team at jody.euloth@askjackie.ca to start discussing you financial future

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb