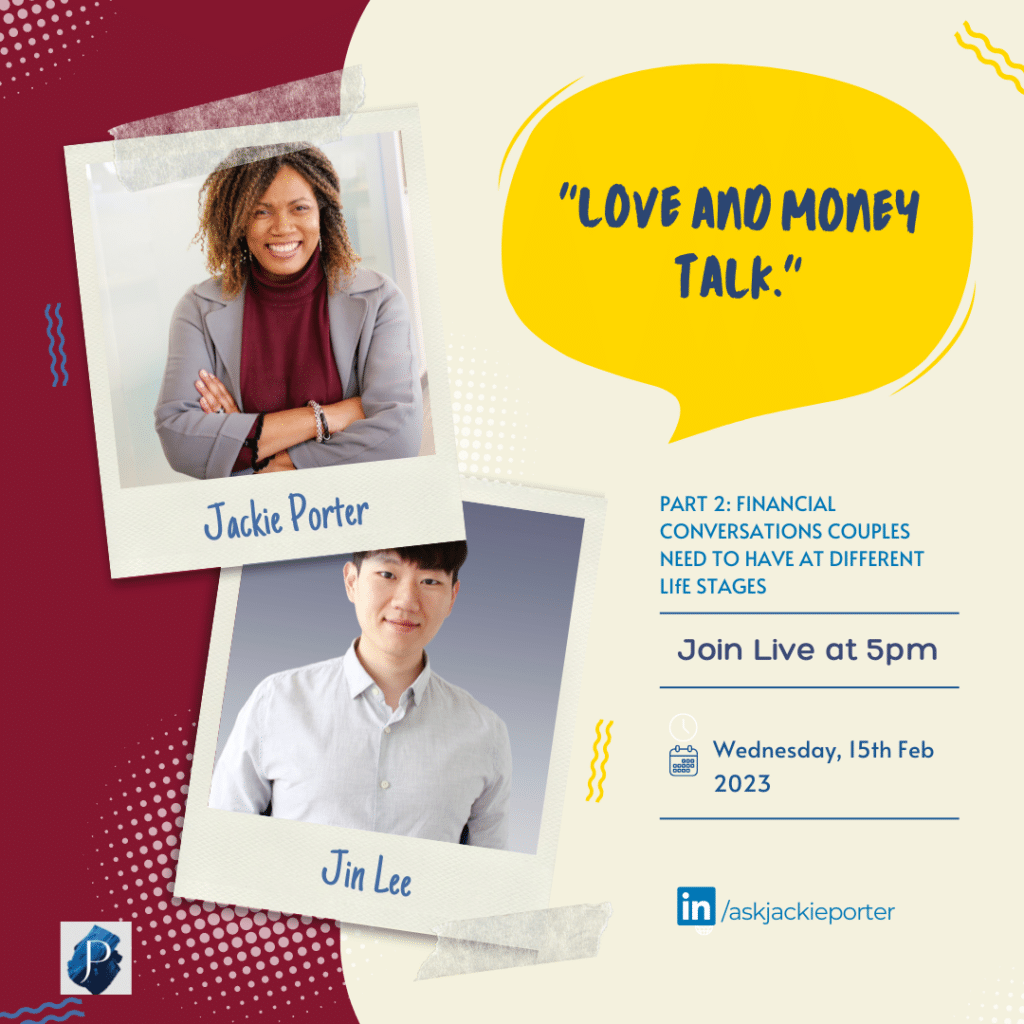

Jackie and Jin are back for part 2 of financial conversation couples need to have at different life stages. This time they discussed passing that honeymoon stage, financial conversations to have at later life stages, planning with kids and navigating divorce. Let’s get into it.

What are some conversation to have once you have decided to move in?

Now that you have realized that your partner is financially dateable and you know each other better, it is a good time to start planning your finances long term. First think about the goals you have for your finances and your life. Short term, think of the wedding ceremony – for this you both need to align your values and come to an agreed budget. Think through what’s important to the both of you and what you can afford to spend based on realistic future plans.

Essential Conversations for new couples

Let’s talk about raising children.

The range on how much it costs to raise children until age 18 is between 186,000 – 2,200,000. That’s not cheap! Couples need to plan to figure out how they want to fund expenses that come with raising children. Another thing to consider is figuring out whose income will cover the expenses while the other partner takes time off to take care of the kids. Remember that different situations require different decisions, so having a conversation helps you think through what you need to do to raise children successfully from a financial stand point.

Organize your finances.

Having family budget is important for financial success in the relationship. You will want to be able to figure out cashflow and net worth as a couple, so you can plan goals together and create a family budget that can help you hit those goals. Think of it from a what do we have and what do we owe perspective and start to build up from there.

Protect your most precious assets.

When buying a home, it is very important that you consider getting insurance protection for the home. It may seem like something that is not a necessity, but there are various kinds of insurance and reasons why you need it. Think of it as protecting your dependents cashflow over the long term since you don’t really know what life circumstances you might face down the road. As financial advisors, our job is to look at your situation and recommend risk solutions needed to protect you and your family long term and ensure you have sustainable cashflow.

Essential Mid-Life conversations

Planning for retirement at different ages

Now that we have talked about goal settings and finances, the next step is to look at building a financial plan so you can achieve your goals to retire assuming different retirement ages and factoring in assets available to fund retirement. You can either hire a financial planner to help you both figure out the numbers or do it yourself. If you’re both busy trying to keep if with work and family commitments, you may not have the time or energy or interest to devote to building a retirement plan. Finances may also be a sensitive subject in your household, so it may be tempting to put off having this important conversation with your partner. Reach out to a financial professional who can walk you through the retirement planning process and give you the peace of mind that comes with understanding how to best prepare for a comfortable retirement.

Essential Later Life Conversations

Have you and your partner set up a will, power of attorney? Do you know what taxes will be owing on your assets on death and are you wanting to leave assets( like a cottage) behind for your children? Planning can get tricky later in life when essential conversations about where assets are located and who should inherit them don’t happen with your partner. Please reach out to jody.euloth@askjackie.ca of you are thinking about getting support around having these conversations. Also, feel free to share your questions or comments on this subject here or on our social platforms

More Financial News & Events

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb

Financial Conversations Couples Need To Have at Different Life Stages

Feb

Disruption and Reinvention: Starting a Second Career in your Forties

Jan

How to create a strong financial fortress during market downturns

Jan

Creating a Financial Vision Board for 2023

Jan

5 Tips to set yourself up For Financial Success in 2023

Jan

Year-end Donation strategies

Dec

Year-end tax planning

Dec

Getting clients organized for 2023

Combating Quiet Spending

Nov