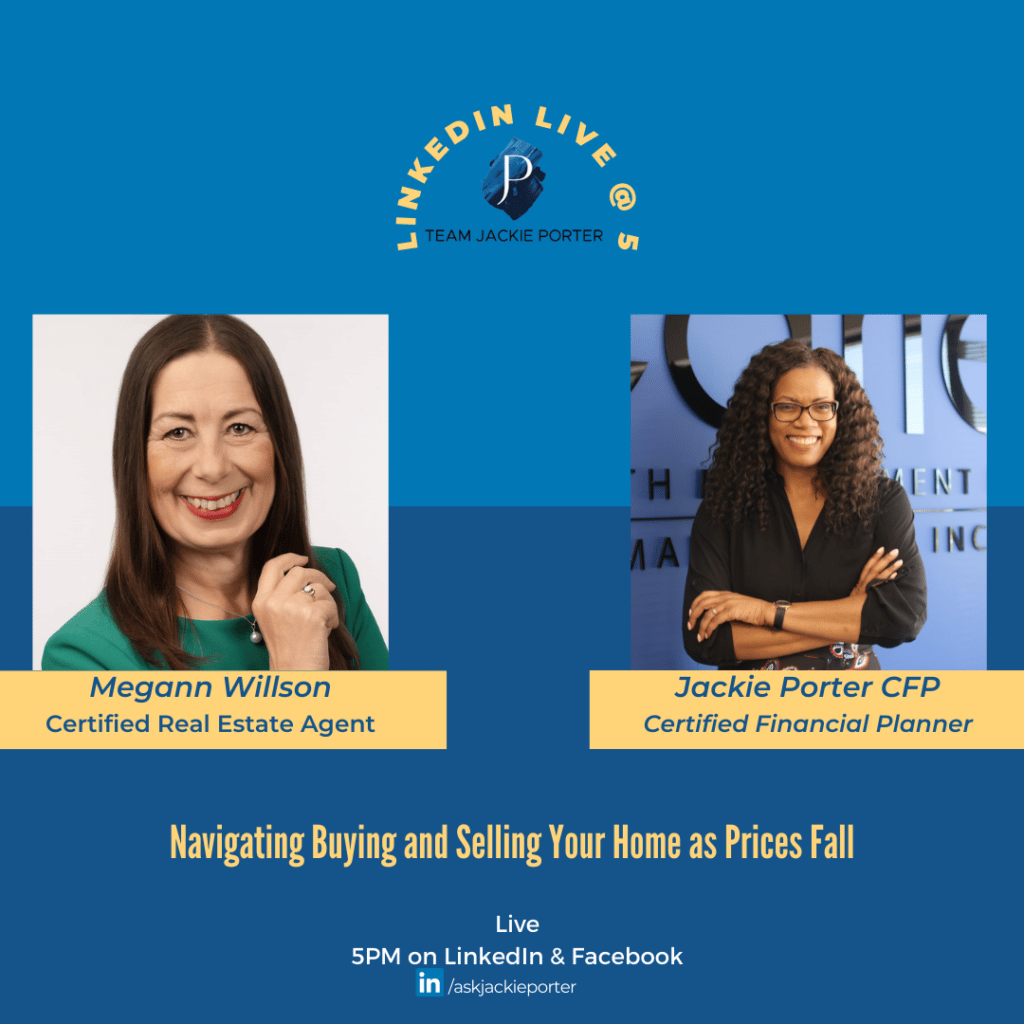

This week we bring you a very informative session with Megann Willson who is a is a Five-Star Certified Real Estate agent, at HomeLife/Realty One Ltd. in Toronto’s exclusive Cabbagetown district. She bought her own first home during a recession, when interest rates were at their peak of 21%, and hasn’t looked back. Read on to get the important nuggets of wisdom she shared last week.

Tell us about your journey to become a real estate expert and what motivated you to choose this field?

Megann started her career in real estate out of her passion for doing what people are mostly afraid of. She was advised by her friend to try it out and she thought why not? Megann eventually took a few courses and kick started her now 4 year long career in real estate. She purchased her first home as an investor when interest rates were at 21%! Since then, she has learned a lot by constantly studying the real estate market with a habit of quickly dispensing things that won’t work and passing on proven buying and selling strategies on to her clients.

What’s the secret sauce when buying or selling in the current market? Is there a best time to do so?

Megann advises that people should only sell if they must or sell if there is really a need to sell as the market is rapidly changing. She also noted that Canada’s real estate market is very different from other countries like US or UK, our market is more rigid because banks are required to try and get repossessed properties sold at its actual worth as opposed to just selling out of desperation. This makes the market very stable and on the other hand more difficult to qualify for mortgage. Plan to hold or own your property for at least 5 years to avoid disappointment. We are in a recession and things are slower this season, but there isn’t such a huge decrease in prices as people make it out to be. The GTA market is still very much in demand and there is still a shortage of supply for the foreseeable future. The most important thing is to manage expectations whether you’re buying or selling.

Bonus tip: having a property that has a basement apartment that could be rented out can serve as a passive income that can help with the mortgage payment. Rentals have also gone up quickly in this market as well.

How much of an impact is the rising interest rates having on People’s buying decision this season?

Megann confirmed that it is making it a little harder for people to decide- especially first-time homeowners as most people are worried what their property will cost over time. The mortgage stress test is also making it more difficult for individuals to qualify. It is still possible to buy a home now people just need to work on saving more and being disciplined. Also, couples benefit from have two incomes to pay the bills over singles buying a property.

What advice can you give our community as they try to navigate the buying and selling market during these unprecedented times?

With a great agent, buy and sell when you are ready and don’t try to time the market. Be sure to use an experienced agent as they are always worth every penny. Megann added that an expert would guide you through what needs to be done before selling or buying in the most cost-effective way possible. Be flexible but focused when buying as well. Bonus tip: when selling, only renovate as much as you are required to without spending a dime more!

Megann can be found on linkedIn @Megann Willson and on other social media platforms @Movebravely. Feel free to reach out to her if you need help or advice on real estate. If you want to get financially organized before buying your next home, reach out to us at Info@askjackie.ca and be sure to tune in to our next live session.

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb