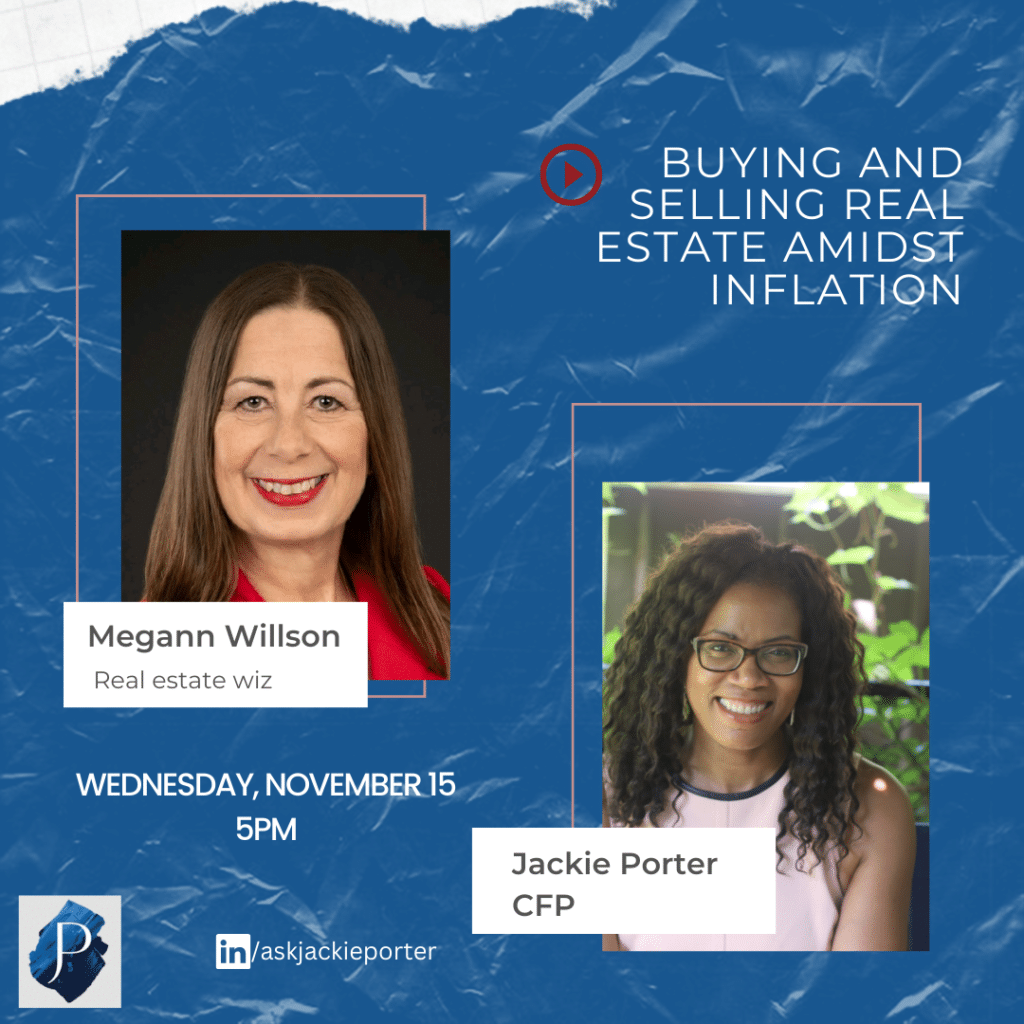

The housing market is a dynamic and ever-changing landscape, influenced by various factors like economic conditions, interest rates, and individual financial situations. In our last LinkedIn live conversation between real estate expert, Megann and Jackie our host, they delved into the intricacies of the current market, offering valuable insights and advice for different scenarios. From downsizing in retirement to assisting children in buying homes, the discussion covered a wide range of topics. They discussed key takeaways from their conversation and provided actionable advice for those navigating the complexities of the housing market.

Downsizing in Retirement

The conversation began with the topic of downsizing in retirement, a decision many individuals contemplate as they assess their financial situation and future plans. Megann highlighted the importance of considering the location where one plans to downsize, emphasizing the drastic changes in the real estate landscape, especially in areas like the Greater Toronto Area (GTA). She encouraged intentional decision-making, stressing that downsizing is not a one-size-fits-all solution.

The financial aspects of downsizing were also discussed. If individuals are contemplating selling a larger property to buy a smaller one, Megann suggested putting some of the proceeds away, seeking advice from a financial confidant, to secure financial stability and possibly fund retirement. She pointed out the value of downsizing in reducing the physical and emotional burden associated with a larger property, making life more manageable.

Challenges of Holding onto Real Estate for the Next Generation

One significant piece of advice shared during the conversation was directed towards those holding onto real estate for the sake of their children. Megann emphasized that, more often than not, children may not share the same sentiment or attachment to certain possessions or properties. She urged homeowners to test this assumption by offering items to their children and observing the response.

The Importance of Intentionality in Downsizing

The conversation pivoted to the importance of being intentional about downsizing, especially for those anticipating future care needs. Megann suggested considering a shift in living arrangements that align with potential health challenges, whether it’s eliminating stairs or investing in features like stair lifts or elevators. The key message was for individuals to maintain agency in their decision-making process, avoiding undue influence from external factors.

Assisting Children in Buying Homes

The discussion then turned to parents assisting their children in purchasing homes. Megann shared a scenario where grandparents offered a substantial amount of money towards their children’s home purchase. However, the children hesitated to accept the financial help, fearing future complications. The conversation highlighted the need for open communication and addressing concerns about financial assistance.

Protecting Financial Interests

When parents are considering helping their children financially, the importance of protecting their financial interests was emphasized. Megann suggested exploring legal options such as prenuptial agreements and having open conversations about expectations and potential safeguards to ensure the money stays within the family if complications arise.

Understanding Mortgage Challenges

The conversation touched upon situations where adult children may face challenges in renewing their mortgage or affording a second round of payments. Megann advised thorough financial planning and evaluating whether there is room in the budget for additional financial commitments. She stressed the importance of understanding the impact of other debts on mortgage affordability.

Final advice

The conversation between Megann and Jackie provided valuable insights for individuals navigating the housing market’s complexities, from downsizing in retirement to assisting children with home purchases. The overarching theme was the need for intentional decision-making, open communication, and a realistic approach to financial planning. As the housing market continues to evolve, staying informed and seeking professional advice remain crucial for making sound real estate decisions.

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb