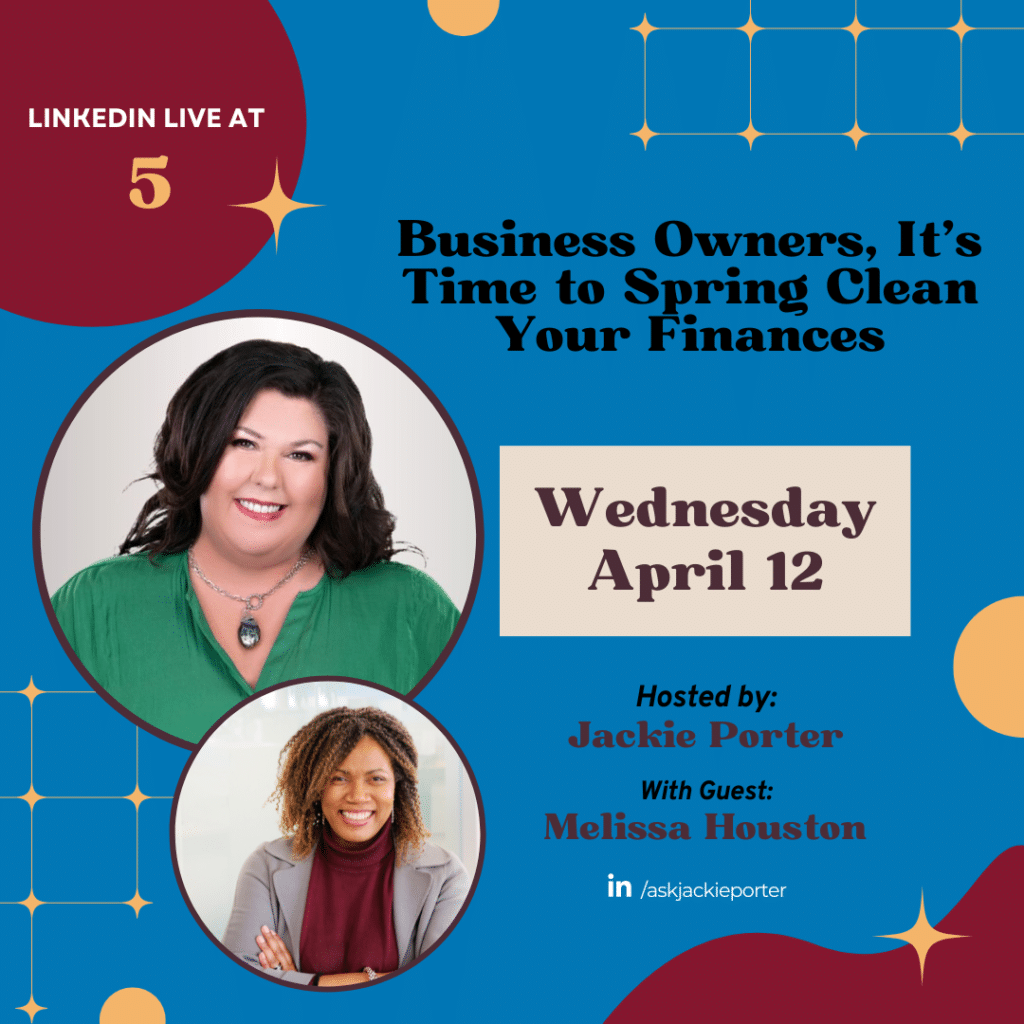

This week Jackie is back with Melissa Houston to discuss spring cleaning finances for business owners. Melissa is a speaker, Author and Forbes writer. She will be letting us know what it means to get your finances organized this tax season.

Are you one of those business owners who pile up receipts in a shoe box and get overwhelmed when it comes to dealing with numbers?

Money matters can be emotional, and you must understand how you relate with your money and what works. Your mindset is the real boss of you! Do not take it for granted. Melissa realized from her years of experience working with business owners and individuals that changing your mindset is the most important step.

Personal finance gets more airtime than finance for business owners especially small business owners. Some business owners feel shame when it comes to discussing their finances and that should not be the case.

Do you pay Yourself What You’re Worth?

It is easy to get distracted comparing yourself with the numbers that 7-figure business owners are doing and don’t realize that you can be a 6-figure business and still be making more money than someone earning more. Remember, it is not about revenue but what you get to keep at the end of the day. Stay focused and face your numbers head on with the mindset of improving how your money is being utilized so you can be in business for the long term.

So many entrepreneurs and business owner struggle with paying themselves and that is not a great way to operate. What is the point of having a business that does not pay you? Set up your business so it pays you instead of the other way around.

How can business owners get organized this spring especially around tax?

The best tip is to start organizing next year’s taxes the moment you file and not wait till the following year to do that close to the deadline. It is important to monitor your numbers month on month as you will end up in a situation where your finances become hard to manage. It is time to start paying attention to your finances, that way you can estimate how much you will be paying in taxes sooner rather than later. Talk to your tax accountant and they can give you an actual average of what you could potentially be paying in taxes before tax time. This will help you to put away that tax money in an account before you need will need to pay your tax bill.

This habit will also give you a level of confidence that your business is where it needs to be because you are tracking numbers that translate to how your business is actually doing versus going along and having no idea. Find a good bookkeeper, be proactive about getting your financial statements monthly and manage your expectations so you get to sleep well at night. Going through your numbers will also let you know how your business is doing financially. For example, are you profitable? Are you spending money on activities that is generating enough revenue for the business? Is your business focusing on the right activities? How will you know this without looking regularly on your numbers?

Focus on Making More Profit instead of Just Paying Less Taxes

Some business owners want to earn less, so they pay a smaller amount on taxes. This mindset is so wrong. Of course everyone wants to save on taxes but not at the cost of making money in their business! It is highly recommended that you work with a highly qualified tax accountant that gives you great tax saving strategies and your business begins to earn more and more income. Maximizing profit and minimizing taxes is a good problem to have versus not making any money in the business.

Meet with your accountant outside of tax season

Melissa recommends working with an accountant that is very collaborative and meets with you ideally on a quarterly basis instead of just at tax time. Meeting with your accountant once a year is going to mean that important information about your business does not get discussed because the accountant may be too busy. It’s also too late to plan to reduce your tax bill as well.

Choose Your Financial Team Wisely!

Remember you are the boss, make sure you hire an accountant or financial professional who is going to meet you where you are, makes you comfortable and gives you that sense of confidence around your financial circumstances. As a business owner, feeling that your finances are in order will make all the difference in pushing ahead with your business! Get your tax documents together and get it in as early as you can so that you feel financial peace instead of a sense of overwhelm! Do not procrastinate any longer and when you start, keep that momentum going.

Mellissa can be reached at Shemeansprofit.com and you can download the five step growth map to a profitable business here https://melissahoustoncpa.lpages.co/5-step-biz-finance-roadmap

Feeling overwhelmed about spring cleaning? Reach out to our team with your burning questions and you can take advantage of our free 30-minute strategy session. Reach out to jody.euloth@askjackie.ca to book a session today!

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb