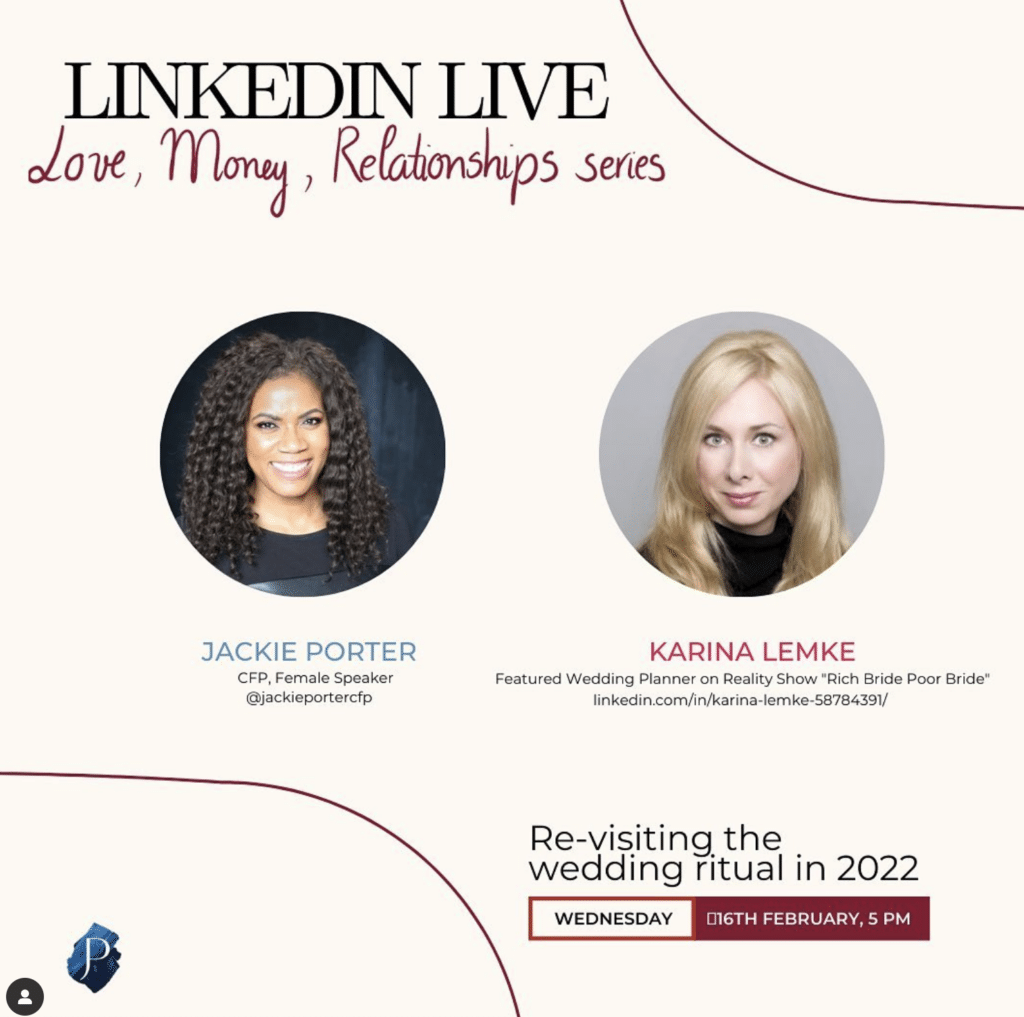

This week on our Live we hosted Karina Lemke, owner Karina Lemke wedding and events and featured wedding planner on the hit reality series, “Rich Bride Poor Bride” to discuss what wedding rituals look like in 2022. Read on for what you need to know.

How expensive is a wedding?

It costs only around 150 CAD to legally get married to someone in Canada. But the cost of the wedding is insanely high. 10 years ago, Karina and her husband invested 46,000 USD to have 50 of their family and close friends join their big day in California. Nowadays, adding the cost of a ceremony, meals with courses and a party, you will end up spending up to 80,000 CAD. It is important to be intentional with your money and manage your expectations when it comes to planning your wedding. You need to discuss that with your wedding planner and be clear about the cost of the activities and the number of guests you are thinking of inviting.

How has Covid impacted weddings and wedding planning?

From Karina’s experience, some people are very willing to embrace the constraints of the pandemic and make the best out of their wedding, some people rage against it and keep disappointing themselves.

In the beginning of 2020, she had 7 clients who were planning to have their weddings in March. They were aware of the virus but not sure how bad it could turn out and how the government would respond. Karina decided to have a plan B even though all her clients were not open to re-scheduling their weddings, one of them was even in healthcare. When the first outbreak was getting more concerning, she was able to have her clients’ weddings re-scheduled to September. Karina chose to react with care and professionalism to uncertainty and was rewarded with satisfied clients.

The same philosophy applies to how her clients are approaching their weddings. Some couples decided to have smaller weddings from 20 to 50 people with everyone required to wear a mask and follow the social distancing policies. Despite the smaller numbers, their experiences were just as meaningful and precious as a wedding should be. Meanwhile, other couples had unrealistic expectations of hosting big weddings of more than 100 people, with big parties just like pre-covid times and were not able to execute the vision they had for their wedding. At the end of the day, how we react to uncertainty impacts our ability to deal with changes!

Is the diamond ring still a thing?

Karina thinks the person who proposes should have the responsibility of sealing that engagement with something of value. In the past decade of being a wedding planner, even though the ring has different value than it once did, she has seen no change in how couples have used a diamond ring to claim their marital status. She also notes that the size of the diamond is increasing, currently around 2.5 carats and used to be 1.0 when she started off her career. However, at the end of the day, your engagement ring should be something you are emotionally connected with. If you are not into diamonds, other gemstones and sustainable and financially friendly options are also available for engagement ring ideas.

What do proposals look like nowadays?

Engagement is no longer a surprise. It is now something that is mutually orchestrated. Karina has been receiving calls from those who want to hire a hidden photographer at a beautifully set-up place for a proposal. However, the one being proposed to, usually, was fully aware this was going to take place. This is completely different from the way Karina was proposed to in California. She was in the middle of taking a shower, with conditioner in her hair, when she was asked by her husband to go up to a balcony where he proposed and gave her a ring.

What should people who want to get married today know?

Being clear on expectations will go a long way, especially with the uncertainty of the ongoing pandemic. Ask yourself what you want out of your wedding, what do you need to make your wedding meaningful and what do you expect from your guests. These questions must be considered with a professional wedding planner, who would give you an estimate amount of investment you have to put on the table. Many planners, like Karina, would not charge for that piece of information, unless you would like them to assist in creating and executing the plan. If you would like to reach out to Karina, you can check out her LinkedIn at https://www.linkedin.com/in/karina-lemke-58784391/.

If you have made it this far, we believe you have learned the importance of money management in love and other aspects of life. Team Jackie Porter is happy to help you build your financial confidence and manage your wealth more sustainably with your loved ones. Hit us up at info@askjackie.ca for a free 30-minute session on financial literacy.

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb