The landscape of senior care is rapidly evolving, and it’s essential to have conversations about how we can ensure a better quality of life for our aging population. In this insightful discussion, Jackie and Jill O’Donnell delve into various aspects of senior care, including the different types of care available, the cost of care, the need for change in how we approach care, and the importance of planning for the future. Jill O’Donnell, an elder care consultant with over 40 years of experience, provides valuable insights and encourages us to take a proactive approach to address the challenges of aging and caregiving.

The Evolving Face of Senior Care

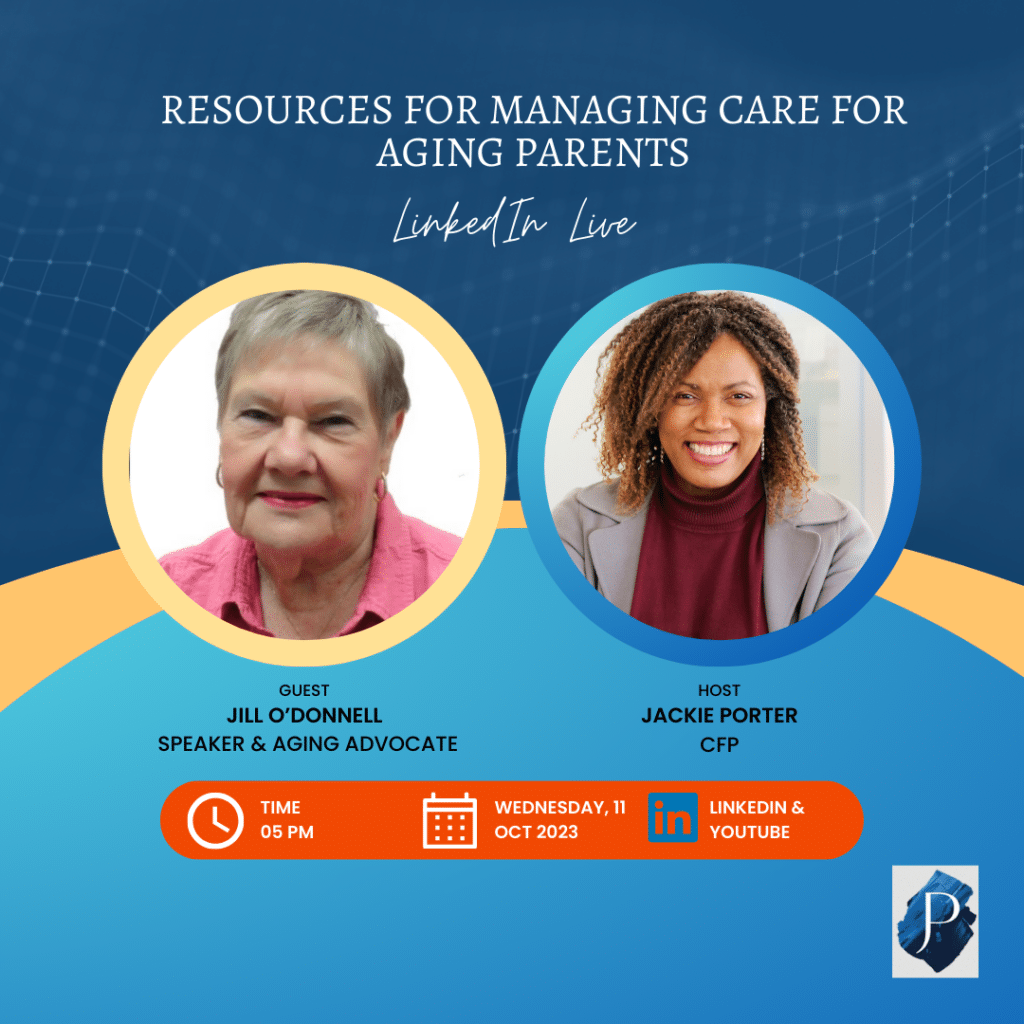

Jill O’Donnell, a seasoned elder care consultant, is also the co-author of “Single by Choice, or Chance,” offering her wisdom on care issues spanning over four decades. Jackie and Jill embark on this dialogue with a mission to make financial conversations around senior care more accessible to all.

Jill’s Journey into Elder Care

Jill O’Donnell opens up about her journey into elder care. Her love for seniors ignited while working as a nurse consultant at Metro Homes for the Aged and later as a supervisor at a geriatric center. These experiences led her to start her elder care consulting company, with her passion for serving seniors at the forefront.

Jill’s journey into elder care demonstrates her commitment to this field, a journey that continues to this day. The conversation touches on the need for open, honest, and compassionate discussions about caring for aging parents, as it can profoundly affect those involved.

The Importance of Planning for the Future

Jackie emphasizes the necessity of planning for our senior years by sharing the story of her mother’s congestive heart failure. Jill reiterates the importance of having a “plan B” and encourages adults to talk to their parents about their future care plans.

Understanding the Different Types of Care

Jackie and Jill discuss the various care options available for seniors, delving into home care, retirement living, and long-term care facilities. Jill provides detailed insights into these options, clarifying the distinctions and costs associated with each.

Home Care: For those who want to remain at home, home care is an excellent option. The cost can vary based on the level of care needed, and Jill highlights the importance of planning and discussing these preferences with financial planners.

Retirement Living: Retirement homes provide an environment for seniors to live independently but with additional care services. Costs can range from $5,000 to $10,000 per month, depending on the location and services.

Long-Term Care: Jill emphasizes the need for proactive planning and financial preparation for long-term care. The conversation covers eligibility criteria and the challenges in accessing long-term care facilities.

Changing the Culture of Care: Jill passionately advocates for a shift in the culture of care. She calls for more home-like settings where seniors can receive care and assistance, yet maintain a sense of independence and community.

A Plea for Change

The discussion concludes with a plea for the elderly to lobby for changes in the care system and demand a more holistic approach. Jill shares her vision for a system where care staff are multi-talented and not confined to rigid roles, enabling residents to lead healthier and more fulfilling lives.

The conversation underlines the importance of financial planning, open communication, and a shift in our approach to senior care. Jill and Jackie remind us that with the right plan, we can navigate the evolving landscape of senior care and provide a better quality of life for our aging population.

Jill sheds light on the evolving landscape of senior care and the importance of planning for the future. It emphasizes the need for open discussions, proactive financial planning, and a shift in our approach to care to ensure a better quality of life for our aging population. Jill’s extensive experience and insights provide valuable guidance for those navigating the complexities of senior care.

Watch full video here: https://www.youtube.com/watch?v=mAPr4MjJ8LI

For personalized financial guidance and support, you can reach out to our client experience manager at jody.euloth@askjackie.ca.

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb