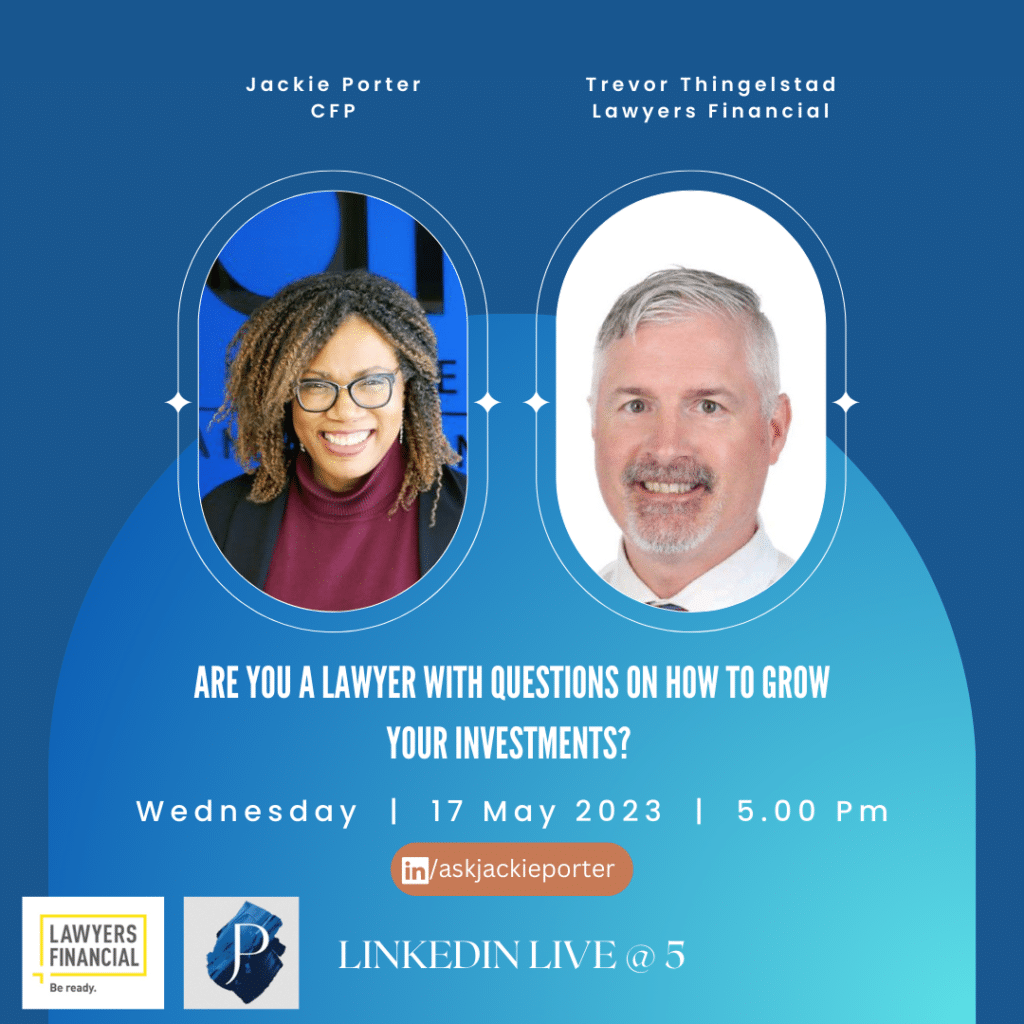

This week, Jackie is back with Trevor from Lawyers financial where they talk about how the team at lawyer’s financial helps legal professionals grow and manage their investments. With all the information flying around the media, there is no better time to talk about how lawyers can manage their investments so they get to enjoy retirement and get a good night’s sleep in this day and time.

As investors, it is very important to always think long-term and stay away from the media as it can sometimes be false or get overwhelming which leads to making wrong investment decisions.

What are some of the reasons lawyers decide to invest?

A lot of new lawyers are looking to start getting their financials right and are conflicted on the best route to take. Trevor gets questions like – do we prioritize paying off debt now or saving for a home? Typically the best advice is to invest in a tax free savings RRSP and use the tax refund to pay off debts.

Trevor also gives advice to Lawyers in the middle of their career or who are almost at the end of their careers looking to get their finances together. Lawyer’s Financial offers free financial planning for lawyers who come in looking for advice. Some lawyers who have their investments spread out in different institutions come in for advice as it can sometimes be overwhelming Managing all of it.

For lawyer’s who are burdened down by the numerous investment fees they have to pay, Lawyer’s financial can help consolidate all your investments and offer you a much lower fee as part of your CBIA benefits. Retirees who still have investments in different buckets find it hard to keep up – maybe it’s time to consolidate all your investments and get an experienced financial planner who can help maximize your investments at a much lower fee while you enjoy your retirement.

How do you help lawyers choose investments?

Trevor typically starts with the risk tolerance questionnaire, it has 9 questions that helps assess what kind of investor his client is and what investment will be best suited for the client. It is important to understand how individuals feel about investments and what they are comfortable doing – are they looking to make a return quickly or comfortable with investing long term? What is their investment history? Especially those who invested pre-covid.

People tend to be more emotional and upset about losing money than they do when they make some money. Investments might not make sense right away and that’s why it is important to work with a financial planner who can show you what can happen to your investments over time. You will see opportunities for your capital to grow even in the midst of the uncertain markets in the coming years.

Uncertainty is real and just like life, we can not know what will happen tomorrow. What’s important is being in the game – focus on your time in the market as opposed to timing the market.

What’s your advice for lawyers looking to start investing?

It’s important to take a step back and get a financial planner, ensure you have great insurance coverage for disability and life before you go into your investment plan. The biggest risk when it comes to finances is not losing money on investments but losing a job, getting critically ill or getting a divorce. This is why a solid financial plan is important. Life experience directly impacts your finances and it is important to get a plan that projects your life and what your income and investments needs are.

The average investor who listens to the media rarely makes the expected returns because they let all the noise affect their decisions.

To build an investment, reach out to Trevor through the Lawyer’s financial website or via his email t.thingelstad@lawyersfinancial.ca. We are also happy to help you build a financial plan that lets you sleep well at night. Reach out to our client experience manager at jody.euloth@askjackie.ca for a free strategy session.

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb