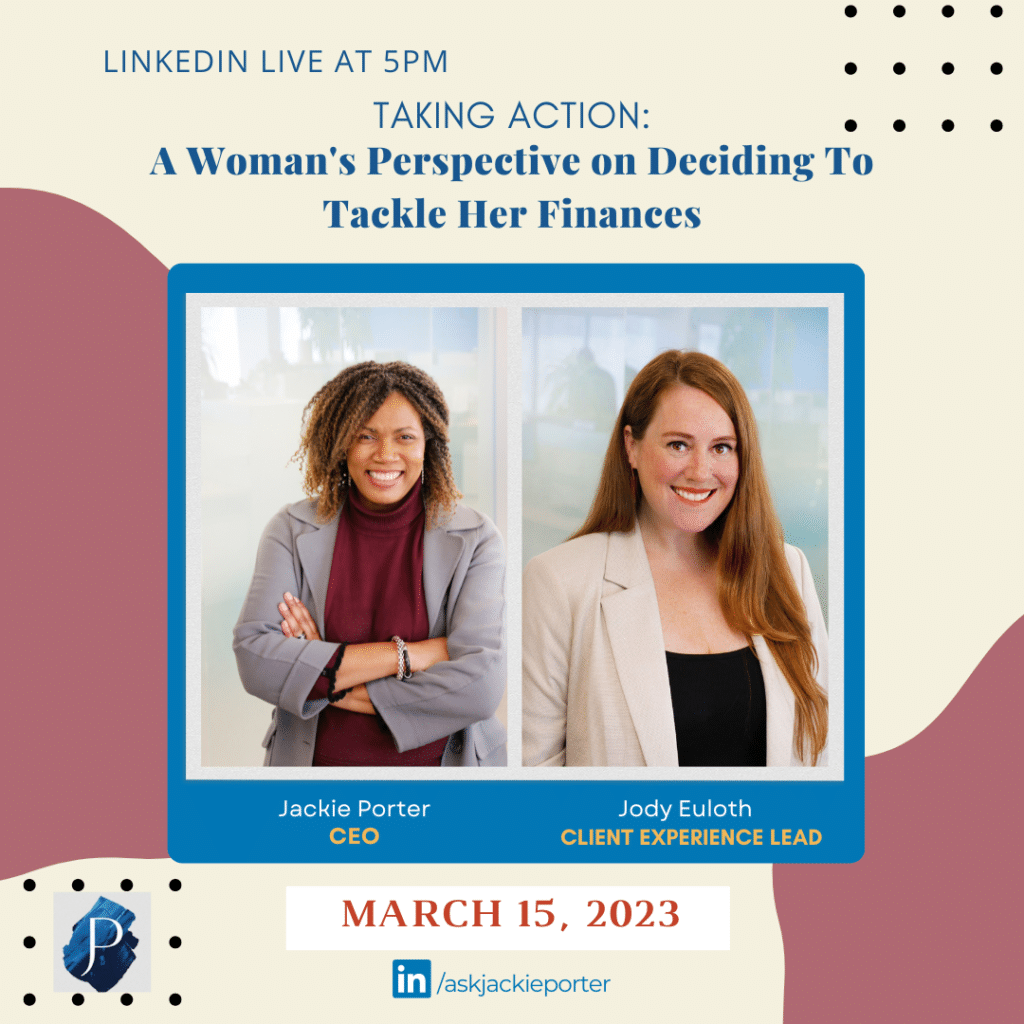

This week’s live session is one for the books! Jackie is back on with Jody, our client experience manager to discuss women taking action to tackle their finances. They start the session jamming to the song by musical Diva Lizzo, It’s About Damn Time! which depicts what the topic really is about. Confidante community, how many of you are not feeling confident about your financial circumstances yet feel stuck and don’t have a plan to move forward?

Jody gave us a bird eye’s view of what inspires our clients to decide that now is the time to tackle their finances. She also shared financial challenges clients might be experiencing since the pandemic and how our onboarding process helps to assure them, they have come to the right place.

What are some challenges you uncover with clients who seek our service?

We find that many people do not know when or where to start, there is a little bit of intimidation around finances that causes them to procrastinate. We find this with higher achieving women who are so busy making an impact that they may tend to de-prioritize getting their finances in order- especially since it may be an area of vulnerability for them. A great example is with filing their income taxes. We have found some of our clients may come to us with a sucessful business that is behind a few years on their taxes so this is typically the first area we may need to work on by finding them an accountant they can work with.

We also find that some women are a little embarrassed about their finances or even talking about it. They sometimes feel like they might not be doing enough and could get judged for being behind when they share details about how their financial position. The important thing for our clients to know is our role is not to judge. There is always a solution for any circumstance, the important part to this is for you to find out what they are. Do not wait until procrastinating starts to cost you. Truth is, the earlier you start, the more options you tend to have.

Do clients often feel like working with a financial planner can be hard?

This fear can paralyze people. Our goal is ensuring that we speak in a clear and plain language that is not riddled with financial jargon, to ensure that our clients are educated about their finances and how decisions they make may impact their future. Our clients also appreciate the patience we bring to the table, so they are comfortable to open up which gives us better results.

What happens when a client says yes to a strategy session?

That is such an important step to take! We call it a financial strategy session, but it really is a get to know you session, we want to get a sense of who they are, identify any dangers with their financial situation, any opportunities, strengths we can leverage on e.t.c the first session is usually casual but very insightful for us to understand the client’s goals by just listening to their story. We also talk about how we can help them achieve their stated goals and what our process looks like.

We also discuss how we are paid and how our fees work. The clients that work with us have a sense of relief when they pay for a financial plan. This helps them feel comfortable that they will not be led through a sales process where the recommendations are solely product recommendations. The fee for service model, also allow us to follow up on the plan we set up, hold our clients accountable to them, and allows our clients to update the plan as required. Clients can choose to set up a plan with us or select another advisor to help them with the product recommendations. There is no pressure based on charging a fee. For the clients who want to set up investment or insurance plans with us, they can rest assured that as independent advisors, we provide third party analysis on the investment and insurance recommendations we provide. This is often not the case with bank advisors who are restricted on what products can be recommended.

Have the conversations changed since covid?

We have found that many people now believe in the power of planning as covid came with a lot of uncertainties that shook the world. Some people realized they did not have a sufficient emergency fund are losing their job. Or did not have adequate insurance in place. We also found that a lot of couples separated during the pandemic and were seeking financial advice since they are now embarking on their new journey alone.

What advice will you give clients who are still considering acting on their financial situation?

Just make that move! Start the conversation, reach out to us and share your situation with us and we can walk with you through to financial confidence. Make sure you work with someone you are comfortable with, be patient with yourself, and be confident that your small steps will get you where you need to be in the end. Remember, No shame, no blame! You are only trying to make a better tomorrow for yourself.

Are you ready to take action? Are you comfortable with your current financial planner? Do you lack confidence when it comes to your finances? We have that proactive, collaborative expertise that you need to start a healthy financial journey. Reach out to Jody at jody.euloth@askjackie.ca

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb