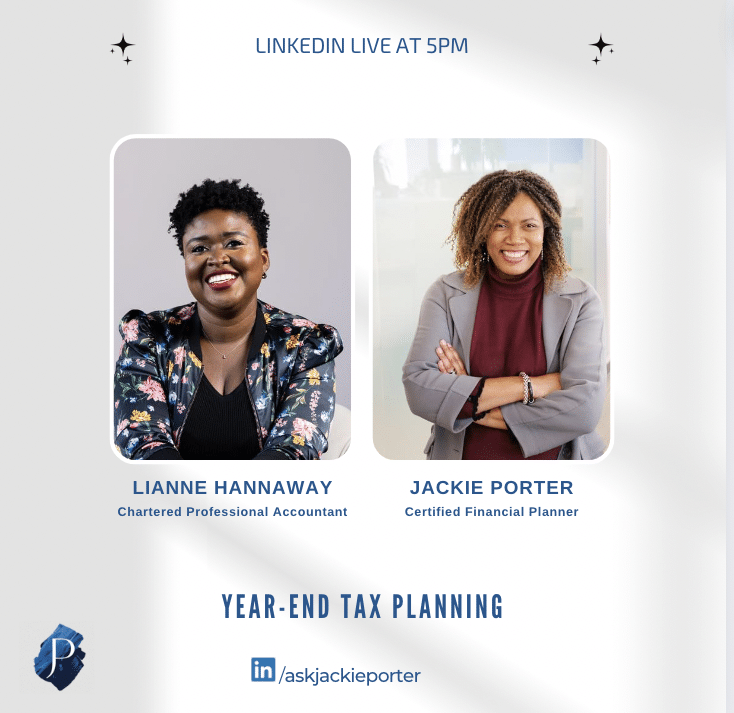

Jackie is joined by Lianne on this episode of live at 5 to discuss tax planning and gearing up for the new year. This is an important time of the year to start looking at how much income tax you are paying and to consider strategies that help you to keep more of your hard-earned money in your pocket. You can decide to pay way less to CRA in the new year just by planning. Stay tuned for all the tips shared by wealth expert Lianne Hannaway.

Tell me about your journey to now becoming a wealth expert

Lianne grew up in Winnipeg with a dream to own a shoe store one day but eventually ended up on a path to becoming a CPA. Raised by immigrant parents, Lianne had a zeal to become financially independent. She has worked with various reputable successful organizations over the years until she decided it was time to pursue her dream of helping small business owners to build successful lives and/businesses by creating a strong financial path. Her business Wealthnuvo, is very passionate about helping women grow their businesses with a strong financial backing, so they are set up for long- term success.

What are some of the tips women need to know as they plan for the new year?

The first thing is itemizing your expenses and getting a handle of what you are spending on because not every dollar that goes through your business is treated equally. Log all expenses according to categories and ensure that they all are the best use of your funds. Also, organize to work with an accountant, be sure to get a good accountant that can guide you through the process of paying as little taxes as possible and to help you plan ahead for the tax bill so its not a surprise.

Have your accountant get you on a program that keeps you on top of your taxes. Remember that accountants have different niches, some are good at taxes, others are more analytical while some are more tax filers. Figure out which type of accountant you need so you engage the right accountant and one that understands your industry. For business owners, it is important to get an accountant that can help you streamline all the numbers and review those with you monthly or quarterly. Doing this doesn’t just save you taxes but gives you an idea of where your business is and what you can or cannot afford as you continue to grow.

How can you identify a good accountant?

Ask questions! What kind of clients do you work with, how do you like to work, what are the ways you plan to engage with me, how often are we going to meet, what comes out of our meetings? These are questions that need to be answered for you to decide to go ahead with an accountant. Asking will help you vet out the most suitable accountant for your business as opposed to just getting an accountant that will only help file your taxes when it is time. You want to choose an accountant that makes you comfortable enough to have honest conversations about your business and personal finances and get support in return.

Why do you think women find it hard to have conversations about finances?

Women were never really taught about money and the system does not necessarily support them when it comes to conversations about finances. From a young age many women are taught not to value the work they do and struggle to charge what they are worth for their services when they start a business. Now women must unlearn some of those narratives and navigate this new reality. It can be tough because they have a high tendency to go right back into that shell and mindset. With more and more successful women in business, there are great examples women can learn from and be motivated to start taking the right financial steps for their future. Financial traumas are real and everyone needs to be intentional about wealth creation and building sustainable successful businesses that pay them what they deserve.

Take charge of your money today and let us help you build your financial fortress in these uncertain times. We are happy to have a 30-minute conversation where we delve into a customized retirement plan for you. Please reach out to jody.euloth@askjackie.ca. Also, feel free to share your questions with us here or on our social platforms

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb