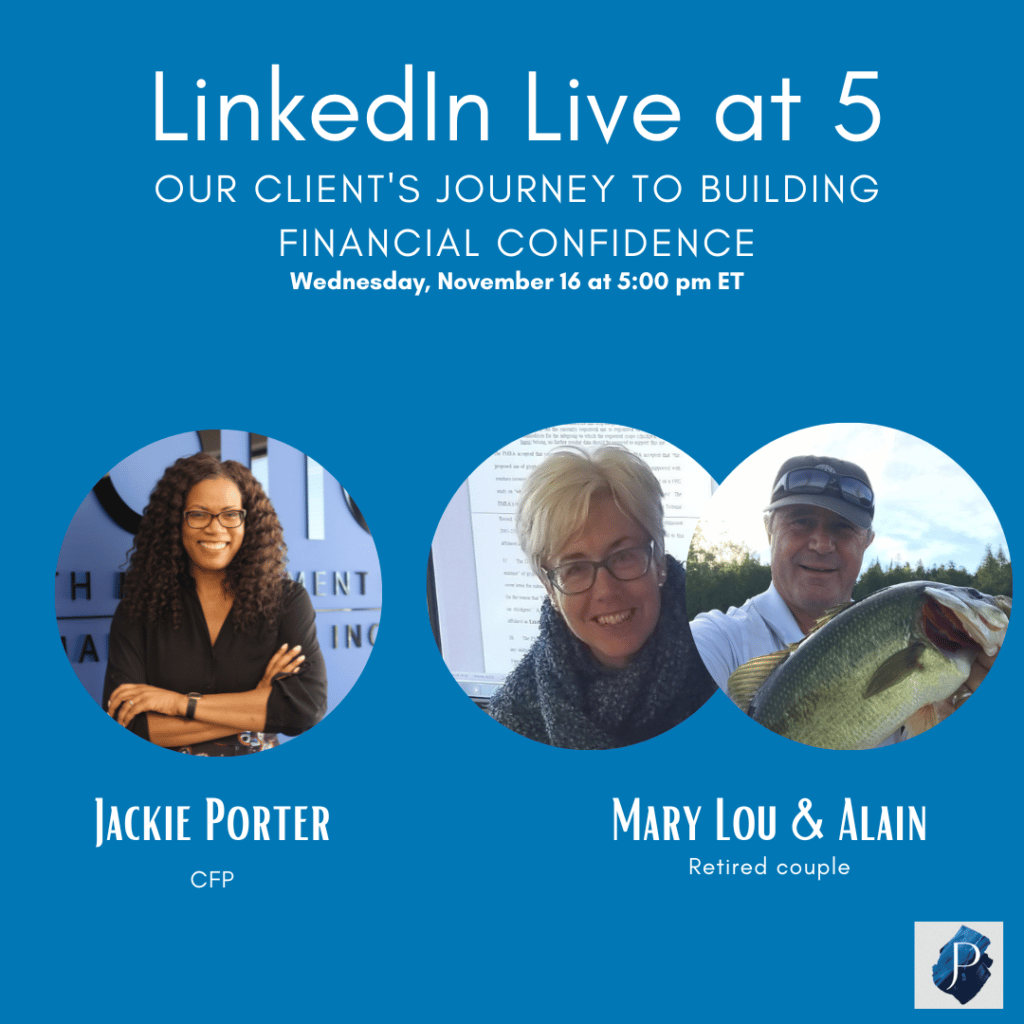

On today’s LinkedIn live, Jackie is joined by our superstar retired couple/clients Al and Mary to discuss how she has helped them navigate their journey to becoming financially confident as their Financial Planner. Mary Lou was a corporate lawyer for 20-plus years and is now working on “retirement wages” for a charity she helped create called SafeFoodMatters.org. Al her husband, had a 38-year career in the chemical industry which was been a continuous learning adventure and he eventually decided it was time to retire. Let’s dive into their journey of meeting Jackie, choosing to work with her and improving their financial confidence in the process.

So, Marylou and Alain what would you like our audience to know about you in terms of your career and what you’re doing now? how did you discover my business and how long have we been working together?

Alain has had a 38 yr career in the chemical industry and Mary Lou has been a corporate lawyer for a couple decades. She stumbled on Jackie’s profile through an ad in the Lawyers Weekly and decided to give her a call. Since then, they have had a very successful relationship. Mary particularly needed a financial planner at the time because she had recently set up a professional corporation and needed help in figuring out how to organize her finances to make the most of it. Many lawyers who have professional corps need to work with someone who understands the ins and outs of professional corps and this is where Jackie’s expertise and years of experience comes in.

What made you seek out working with an advisor at that time?

Going into retirement is a very big decision, and it goes beyond just understanding the numbers, it is always a great idea to seek outside opinion on what the numbers mean and possible scenarios that could come up, in terms of good markets and bad markets, big spending decisions and figuring out what other factors may come up that they may not have thought about. Sometimes, not knowing what you don’t know and planning for retirement can be tricky without talking it through with a professional.

What are the main reasons we are still working together now?

Speaking on why they chose Team Jackie, Mary stated that she once had a financial advisor whose plan really didn’t align with their personal goals. So, the difference is they were imposing as opposed to getting to know us and then creating a customized plan that aligns with our values and goals. Because of this, they could not really trust the advisor’s judgement. Al added that it was so easy with Jackie, that he was comfortable almost immediately they started to work on a plan together. The decision to go with Jackie was born out of a 15mins quick conversation where she was able to give them a realistic picture of what their finances could look like and how she can help them achieve set goals. Alain, immediately thought ohh.. she knows what she is saying!

What convinced you to retire and move forward?

Mary stated that they have been thinking about it for a couple of years, they even already built a lake property in preparation for this big move since 2015. They just were considering the numbers and how they can make use of what they had built so far to make the retirement dream work. Working with Jackie kind of put them at peace because she made them see the possibilities through realistic strategies. The plan put them at peace and made them more confident in their decision to retire.

What were the most important questions you wanted answers to as we went through the planning process?

Mary stated that the biggest questions was will we be ok? Even in a recession will we be, ok? With the current uncertainty we are all experiencing, how can we better plan for worse case scenarios. Jackie has a way of making us understand that it will be ok, the worries are all mental and a great financial plan gives a good picture of what the future looks like. Alain on the other hand wanted to understand the numbers a little more depth, he needs this to know what they would be able to afford on this new journey and the big life transitions that will potentially come up.

In your own words how does working with an advisor improve your financial confidence?

Mary states that she has never known much about numbers, so Jackie has been so helpful in really educating her on what the numbers are and how they move from point A to B. Alain on the other hand, is a numbers guy to an extent but he added that it is not in the way Jackie understands it. She is not just an expert in the field but has an ability to make us clients feel confident because she is very thorough and strives for us to understand where we are at and what’s to come. They have also found that Jackie and the team are constantly on top of market trends, and she would always look to adjust their plan accordingly which has helped over the years

What advice can you offer someone who is worried about their finances at this time?

According to Alain, understanding the numbers are crucial for success. Getting comfortable or building a relationship with an advisor you can trust is a good thing to do because they are experts in that field, and they can bring their years and years of experience to your situation. Jackie also tends to be invested in understanding their personal lives and what matters to them. This gives her a deeper understanding of what would work for them when making recommendations and contributing to a great overall experience.

Have you considered what your financial future looks like? Do you feel confident about you current financial situation? We are happy to have a 30-minute conversation where we delve into a customized retirement plan for you. Please reach out to jody.euloth@askjackie.ca. Also, feel free to share your questions with us here or on our social platforms

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb