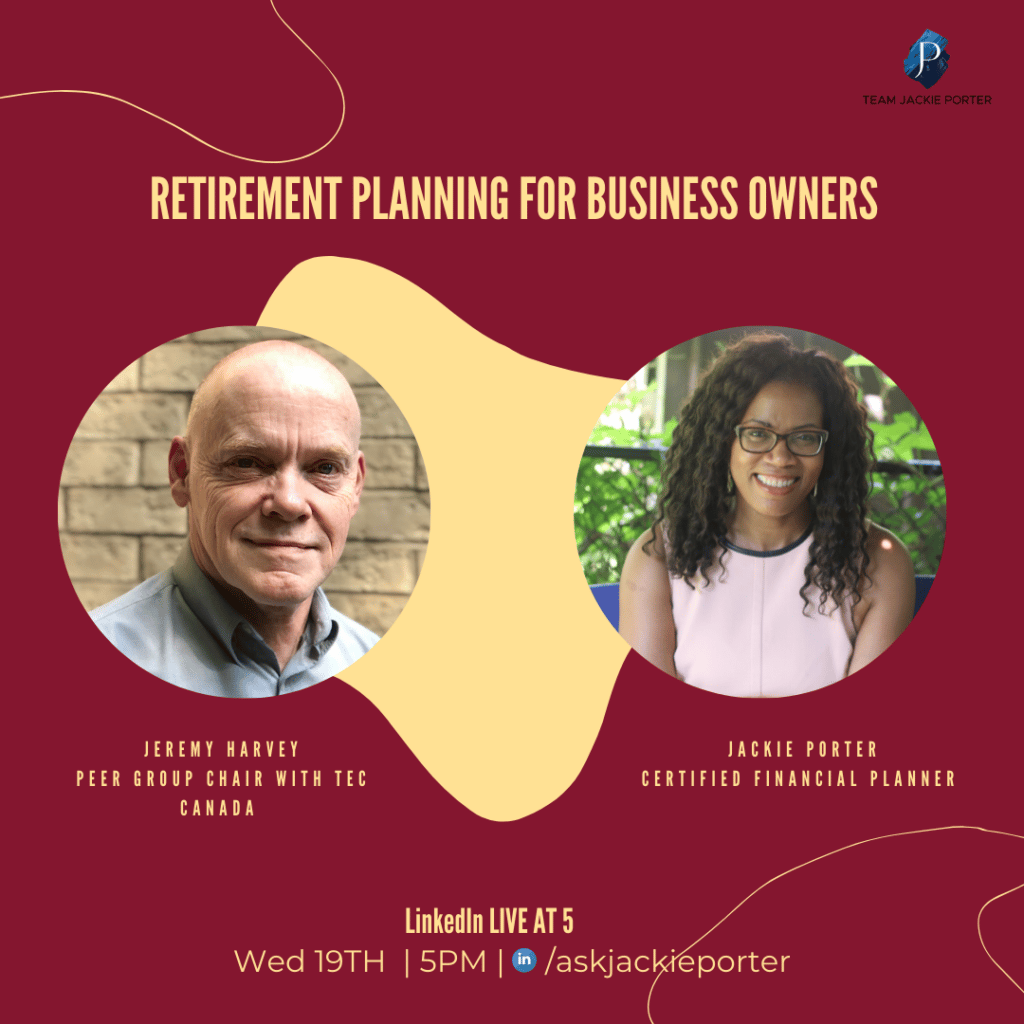

This week we bring you a very informative session with Jeremy on retirement and exit strategies for business owners. In case you haven’t noticed, our theme for this month is retirement and this is just one of the many topics we are touching this October. Be sure to stay updated with our content via our social platforms. If you are a business owner and you’re wondering what retirement would look like for your business and for you, you have come to the right place. Jeremy Harvey’s goal is to support the next generation of leaders and he is currently the Peer Group Chair with TEC Canada. Let’s dive into the conversation.

Tell us about your journey to be becoming an entrepreneur?

Jeremy started off by learning marketing, buying, and selling businesses and honing those skills over time while in the UK, he then moved to become a consultant which gave him the opportunity to travel the world. Somewhere in the middle of his successful career, he realized his main goal is to help people, particularly small businesses. He eventually joined TEC Canada and started building and transforming businesses and that’s what he is still excelling at in Canada. This is such a unique path because it allows him to share his gift with other businesses to help them prosper.

What are business owners missing when they start deliberating exiting their business?

Jeremy states that people are usually thinking about it too late. When a business owner starts a business, they should be forward thinking and have an exit strategy in place right off the bat. It’s important for positioning but the main reason is that you should be thinking of building a business that’s sellable or one built with a good business structure that is easily adaptable or attractive to potential buyers. Basically, business owners should begin with the end in mind. Jeremy has observed over the years that people typically ignore the ‘business’ part of starting a company and focus on the passion/skillset part. From the on-set you want to build a business that can run when you are not there to allow the business reach its full potential.

What questions should business owners ask themselves as they begin to plan for retirement or an exit?

First, they need to figure out why they are exiting? And what the plan will be moving forward. The objectives usually vary based on the individual or business type. Questions to ask should include, do I have a successor? What will I use the money from the sale to do? Will the business thrive when I leave? What’s the succession plan? Etc. Jeremy added that it is important to set up a business that can run without you just in case you choose not to be part of the operations. In some instances, business owners stay after a sale and essentially become employees for a period of time.

How will a business owner know if they are getting value for the business they are about to sell?

It all depends on the industry, and you need a competent valuator who is familiar with that industry and what your type of business will be worth in the marketplace. Jeremy gave an example of a business he consulted for that was going to take a certain amount from an investor but after consultation with his team, they realized they were being undervalued. That consultation eventually landed them a 70% increase in valuation. Similar to a having a competent real estate agent knowing the value of your property or potential value with a few repairs or renovation, a business consultant familiar with your business can make all the difference and getting you closer to the price you want to sell for by suggesting structural changes to make your business more valuable.

How can business owners determine if it’s a good price and how do they know when it’s a good time to sell?

Jeremy’s answer to the initial question about know how to know if your business isn’t being undervalued is that you will need an experienced advisor to guide you. Getting an advisor is important because they can use their wealth of experience to compare with other industry trends/prices. In terms of timing, that is usually decided by the business owner, but if you do not have a definitive time, you want to wait until the market is at its peak and you have structured your business operations to thrive without you. The best strategy is to think widely and then begin to narrow it down with the help of your experienced advisor. It is important to have intellectual property and processes set in place to keep the business running successfully after you have exited or retired.

What is a big lesson business owners need to learn/know about exiting or retiring from their business?

Business owners tend to go into it alone and may not realize they can learn a lot from other business owners and through mentorship. The key lesson is to seek support from other business owners and professionals as you grow your business and remember to create a business plan with long term goals, rather than just thinking about where the business will be tomorrow. The main thing is to think 4/5 years ahead as opposed to 6 months ahead. It helps you strategize better and put in the appropriate processes in place you are likely setting yourself up for a great future valuation, business success and the opportunity to secure your retirement!

Jeremy’s work at TEC Canada involves helping small business owners thrive and achieve business success but more importantly life goals through peer groups. Should you need more advice, be sure to reach out to him.

Jeremy can be found on LinkedIn @Jeremy Harvey.

Contact details

Email jharvey@tec-canada.com

T 416.301.7279 TEC-Canada.com

Remember also that a successful retirement as an individual or business owner is possible as long as you plan and strategize based on your situation and potential life stages. We are happy to have a 30-minute conversation where we delve into a customized retirement plan for you. Please reach out to jody.euloth@askjackie.ca. Also, feel free to share your questions with us here or on our social platforms

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb