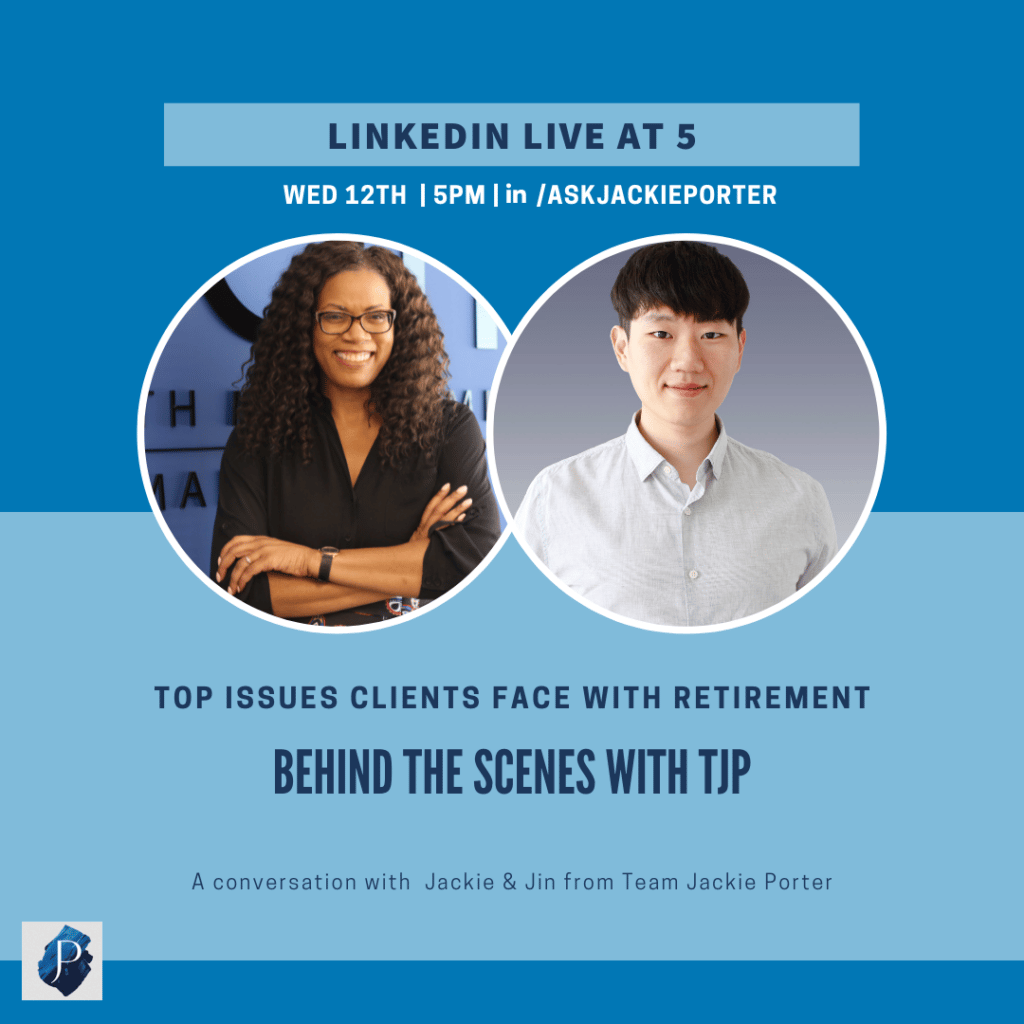

Hello confidante community! We are back with another Ask TJP series and this time our in-house Certified Financial Planner Jin Lee is on with Jackie to discuss some of the issues clients face with retirement. Jin and Jackie will be discussing some of the issues clients face with retirement planning and tips to prepare financially for retirement. Longevity means people can spend up to 40 years in retirement if they retire at age 60. So that makes retirement a big life event with many stages to plan for. Ask yourself are you prepared for retirement? Let’s dive into the insightful conversation on planning for retirement may look like.

What are some of the concerns people have when thinking about retirement?

For clients getting ready for retirement or even at the retirement stage, a big concern usually is, ‘do we have enough assets to last us for this 40yr period? Are there enough assets for the various events that could come up and will we eventually exhaust these resources?’

Will the 4 percent Rule Account for my situation?

The second concern is the 4% rule which states that as long as you spend only 4% of your assets, you will not outlive your asset. The question is does this rule still apply in the current market? Right now the answer is vague and dependent on different situations and based on the different life stages in retirement. It is really about how your life & expenses flow in retirement and how you spend during each stage of life. The 4% rule is a little rigid and might not apply to some of our clients based on their life/ retirement dynamics. A financial plan will give you clarity on what your situation will look like based on specific events in your life as opposed to the generic 4% rule template.

What if I own a lot of real estate? Will it give me enough cashflow?

Another popular concern is the issue of being real estate rich with less cashflow especially in a market like this. Some of the questions are if they will even be able to continue to manage these properties in retirement.. As interest rates creep up, mortgages are now more expensive and some people will end up seeing their property values go down if they own real estate as interest rate risk affects home prices. Some clients are now looking to liquidate some of their real estate assets so they have cash on hand to generate an income stream in retirement. Its also important to diversify and not have all your eggs in one basket. Having cash is also critical in this era as so many things can potentially come up that will require cash and if your funds are tied up in real estate they may be hard to access, and after interest and expenses associated with the property, you may not have enough income to pay for your retirement lifestyle.

How does most of my assets in RRSP’s affect my personal tax rate in retirement?

Some of our clients have to worry about having a large RSP balance, which eventually means clients will have a forced minimum withdrawal balance from their investments. It’s ok to have a large or small RSP balance but the issue is the bigger the portfolio the more the taxes and potentially starting to lose their old age security benefit if their overall income is above $79,000. The solution is to plan ahead and have your assets structured in a way that you won’t paying more taxes than you need to especially if you do not need to use the entire minimum RRIF payments. As financial planners, we can create a cashflow projection plans for you to get the RRIF payments during your earlier years to give you more time to pay off those taxes over a longer period of time. We will help you figure out where your income streams will come from, are they taxable or tax efficient so you can have a good picture of what your tax and lifestyle income will look like throughout all of your retirement life stages.

Have a plan that ensures you can live the retirement you want no matter what the market does. Ask Team Jackie Porter….

Many people had big plans for retirement and were hit with the current market downturn which means a lot of spending plans are affected. When clients come to us with this type of issues, we recommend the cash wedge strategy to them where they can put 2 years of lifestyle expenses in high interest savings account to fund their retirement so they don’t have to tap into their retirement accounts at the wrong time.

A financially secure retirement is possible as long as you plan and strategize based on your situation and potential life stages. We are happy to have a 30-minute conversation where we delve into a customized retirement plan for you. Please reach out to jody.euloth@askjackie.ca. Also, feel free to share your questions with us here or on our social platforms

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb