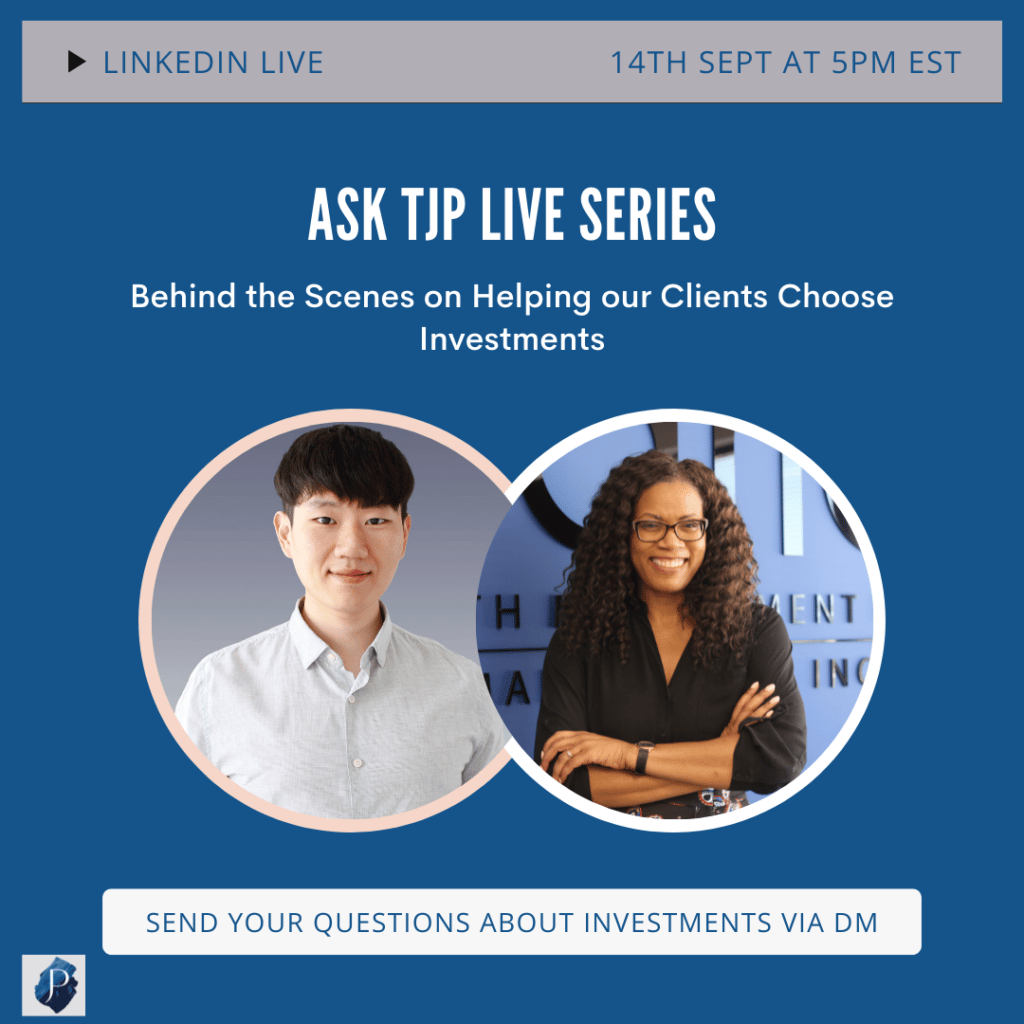

Hello confidante community! We are back with another Ask TJP series and this time our in-house Certified Financial Planner Jin Lee is on with Jackie to discuss the process of choosing investments for our clients. As the markets are down, we thought it was important to share our process for helping our clients to make sound investment decisions regardless of the constantly changing markets. In this conversation, the team was able to walk us through the process of helping our clients make the right investment decisions aligned to their long-term financial goals so they can improve their confidence when making future investment decisions!

What’s the first step we use when recommending investment strategies or opportunities to our clients?

We start with ensuring that the clients are comfortable with the decision they would be making, and to achieve this, we ask them a series of questions to ensuring we are choosing the right investments suited to the clients’ goals values and risks. The goal of this exercise is to really understand what kind of investments they are truly interested in and the level of market volatility they can withstand as market conditions change.

To do this, we send out a detailed risk tolerance investor questionnaire to assess their ability to withstand ups and downs in a specific group of investments they could potentially select from and give them feedback on their results. The main goal is to ensure that they can sleep at night with an understanding of what their investment portfolio could look like as economic risk factors change. Reviewing scenarios with the client of potential returns they can receive from potential investments in good and bad markets give them a reality check! At the end of the day, we want our clients to understand that there will be ups and downs in the market, and they will need to persevere and stay invested to get the desired returns they seek over the long-term.

Bonus Tip: the media is not your investment advisor! It only creates panic that could end up leading you make the wrong investment decisions. It is important to stay the course especially when investing for long-term so for us taking our time to learn about the client before making recommendations is crucial!

The second component of the journey to investment for our clients is to assess their already existing investment portfolio to get a sense of what they have been exposed to in the past. Getting a look at their portfolio helps us recommend a variety of opportunities. We try to ensure they don’t have all their eggs in one basket to avert risks. Take, for example, there was a time when people thought real estate was the best investment option as the chances of the market dropping were very low but look at what is happening in that sector now? Perhaps they are overweighted in the technology sector. We help our clients understand that no asset class is safe, and it is important to diversify investments to reduce the impact of a specific drop in the market affecting your portfolio.

How are you able to align the process of choosing investments for clients with the overall financial plan?

We recommend investments based on how much is needed to attain the set goals in the financial plan. Clients typically give us a picture of what they want their retirement lifestyle to look like in the coming years and we recommend investments that would help them achieve that goal. Next, we do a scenario test, where we stress-test the selected portfolio based on the minimum return the investment needs to earn to provide the desired lifestyle in retirement.

After scenario testing, we dive into the details of the investment and factor in the after-tax cost of the investment they choose. At this stage, we start to talk about what type of investment vehicles should be considered to meet their goals. For example, should the investments be made in an RRSP or TFSA? What investment type would provide the higher after-tax return? We also give advice to clients on investments that are external e.g., through employers, as many of our clients tell us they often do not get guidance on how their defined contribution plans should be invested. In our role as a investment broker, we can provide referrals to our various investment partners in the area of mutual funds, ETFs, individual stocks and private wealth management based on what makes the most sense for your specific situation.

How are we able to align our client’s investments with their values?

Now more than ever, clients are particular about the type of investments they make and if they align with their core personal values. We find that clients have different wants based on how much they care about their environment, government, or humanity. Some our clients, especially some of our female clients want to make sure that they are not indirectly rewarding sectors that aren’t socially responsible, such as sectors associated with the Russian Government, tobacco companies, or companies that harm the environment such as the oil sector.

Overall, we ensure that our clients are making the most suitable investment decision based on all the factors they care about along with how much losing money in the markets impacts their ability to stay invested. Whether aggressively investing or not, our goal is to help our clients to make the right investment decisions to ensure they are on track to retire successfully and beyond.

The biggest takeaway from this session is to remember that feelings are not facts, and you should not make investment decisions from a position of panic. Feel free to reach out to us if you need a professional second opinion on your investments and financial future. Team Jackie Porter is happy to walk you through your investment journey. Contact us at info@askjackie.ca to schedule a free 30-minute consultation with the team

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb