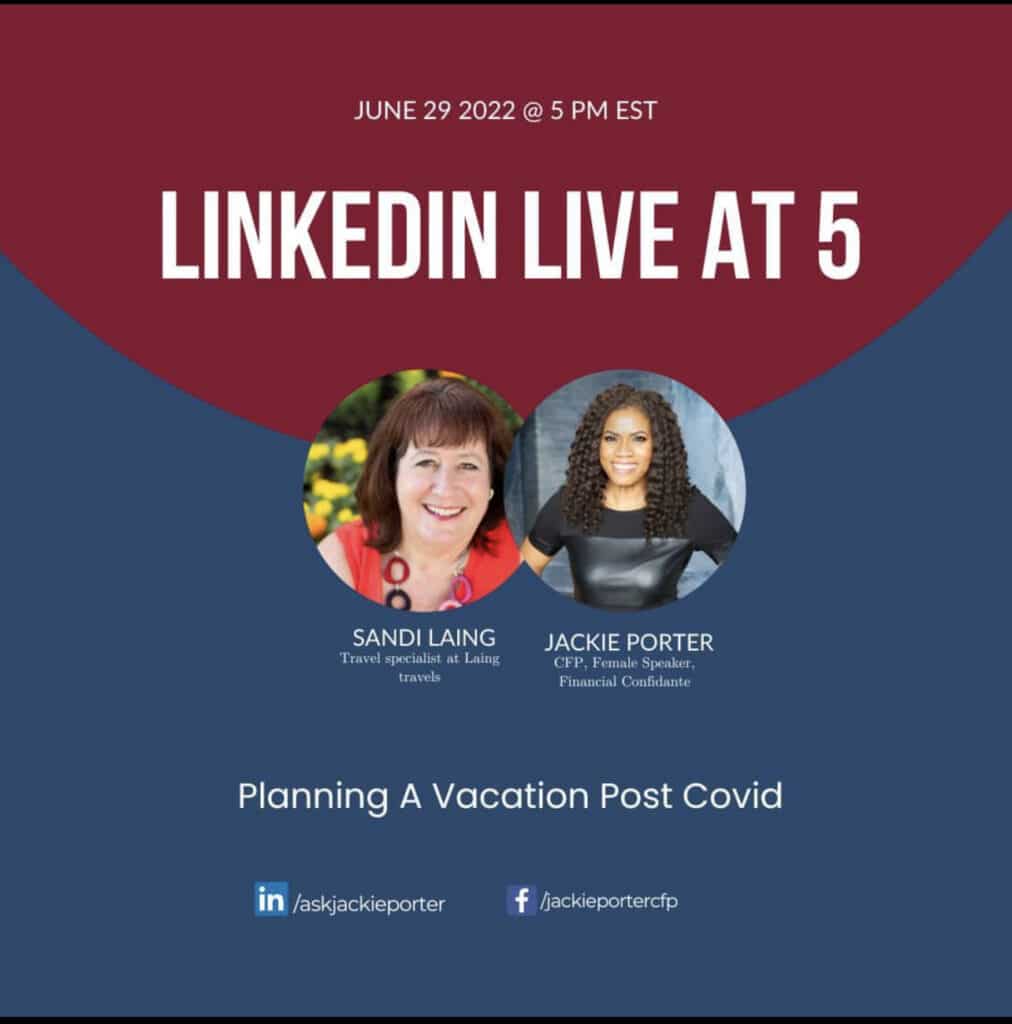

We are back again this week with “Live at 5” with the Financial Confidante for another interesting conversation with travel expert Sandi Laing of Laing Travels. She came ready to give us all the info we need to plan trips this summer. Just in case you also didn’t have plans to travel but deep down you know you need a vacation, then you should read on. We are sharing tips on how to plan financially for your next vacation and how you can secure deals ahead of the trip.

What are travels looking like now? What should we expect

Traveling now is very different from what it used to be despite coming out of covid lockdown. The travel requirements are changing by the day so travelers need to check and recheck until they fly to avoid any surprises. It is easing up, yes, but there’s still a lot of due diligence needed ahead. It is also important to note that travel requirements can be country specific.

What are travel costs looking like post pandemic?

Travel costs have increased as gas prices have increased.There is also a pent-up demand from the last two years. The travel industry is trying to recall staff to meet this demand, this includes the airline industry, airport staff and hotels to name a few. The reality is after two years many people in the hospitality industry have moved on so trying to ramp up and restaff will take time. Also, many people in the tourism industry are fearful of another covid outbreak and do not necessarily want to overbook either. Last minute specials are harder to come by as hotels aren’t booking 100% because they don’t have enough staff to accommodate full capacity. All these issues tie into the travel prices being more expensive right now with minimal deals.

What can we expect in terms of delay?

The scarcity of staff across board has affected waiting times, loading, and unloading bags, security etc. these are some of the reasons you experience delays at the airport. So, the tip would be to arrive early and pack your patience! You will get to your destination eventually and after so long, the inconveniences of travel pale in comparison to getting out on vacation again.

What can people do to save costs when planning trips?

Planning ahead by booking the vacation as early in advance as possible is key when it comes to saving money. Especially because the airlines are scaling back the number of flights going out to many countries. Booking travel in advance also means booking rentals for cars and side trips before you go as access to these services are limited as well. So expect to book early to get to the airport early, if you’re booking a connecting flight you need to catch at another destination that is crucial, It is a good idea to get to that other destination well in advance as well to avoid disappointment due to last minute cancellation of flights. Finally, get all your bookings for hotels, side trips and rentals booked early as they are very limited as well. Then you can get to your destination and thoroughly enjoy your well-deserved vacation! Remember when you fail to plan, you just end up throwing money at the issue.

Travel Local and Take advantage of the Staycation Tax Credit!

There is a staycation tax credit that the government of Canada is offering, to save on local travel. It offers a 20 percent tax credit for up to $1000 dollars. For a family of two the tax credit is based on $2000 dollars. Reach out to us at info@askjackie.ca to get more information about claiming that tax credit.

Sandi’s final recommendation was that we book our trips through a TICO certified travel agent as it will save you money and of course the trip would be a lot more convenient as these agents have access to an unlimited number of suppliers across the board.

If you have been worried about planning your finances and how you could possibly afford a vacation, reach out to us at info@askjackie.ca for help. We are certified financial planners with a wide range of experience in helping people plan better for a better life.

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb