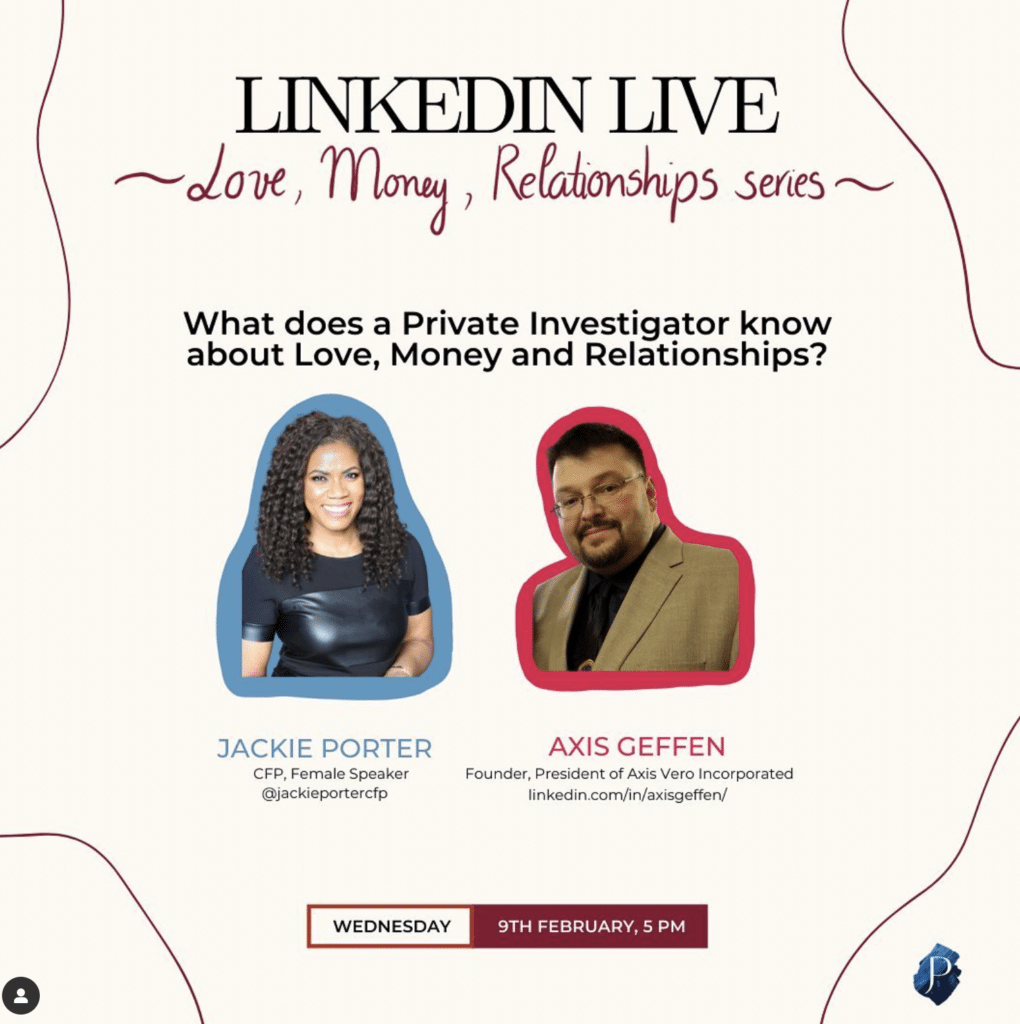

This week on our LinkedIn Live we talked to Axis Geffen, a private investigator. Axis is the Founder and President of Axis Vero Incorporated, a Canadian Private Investigation Firm offering professional investigative services to a variety of clients, including law firms, self-represented clients and supporting a number of established Private Investigation and Security Agencies worldwide. He is also a Canadian Private Investigation Firm offering professional investigative services to a variety of clients, including law firms, self-represented clients and supporting a number of established Private Investigation and Security Agencies worldwide. Team Jackie Porter was very excited to learn more about Axis’s job as well as what being a private investigator teaches him about Love, Money and Relationships. Read on to learn more about what you need to know…

1. Do you need to lose trust in your relationship to reach out to a PI?

A common perception with the private investigation industry is that people associate distrust with the service. While in some cases, private investigators do work for those who has doubts in their partners. However, people can hire private investigators if they want to be aware when things feel like not adding up to the way they want, or they just want to be prepared. A good example is when a wealthy family wants to buy a house for their child before his marriage. They might hire a private investigator to learn about their son’s partner to understand that their loved one ends up with a well worth it life after marriage instead of a complicated relationship with someone who only aims for the house.

2. Is the life of a PI as exciting as it seems in the movies?

Not exactly….Every day at work is different for private investigators. Investigators do not wear tight suits, use unique spy equipment, and breach the laws as perceived in films. They are in action and keep themselves updated with the administration process of the governments and their companies. For the past 30 years, Axis has witnessed a lot of changes in the industry, and he could confirm that none of the movie personalities of private investigator fit is reflected in real life, at least for him. Often the PI’s are doing surveillance and research work for their clients.

3. How do clients go about finding a good PI Service?

Axis’s clients found him mostly through the words of mouth, Google, and referral from law firms. However, he warns those who use Google to find these service to be skeptical about the information they are reading. The 5 star Google reviews for a private investigators might not come from a real client. In his experience, people are afraid to be associated with using the private investigation service. Therefore, they would rather express their appreciation through letters or emails instead of publicly.

4. What is Financial Infidelity?

Axis breaks down financial infidelity into 2 categories:

– When either of the parties in a relationship has inappropriate spending habits and is hurting the family finances.

– When one partner is controlling the money without being open and communicative.

In either case both parties will not feel confident about their financial life. Sometimes the signs are clear that people in the relationship could have a conversation and work on finding a solution together. However, there will be scenarios where signs are hardly noticeable. This is when the private investigator should come in and help figure out the problem.

5. What being a private investigator has taught Axis about Love, Money and Relationship?

Love and money are complicated. Love is subjective and everyone sees it differently. Different needs in different situations could break a relationship without proper communication. Money, on the other hand, is not subjective. It has a set value and will not change as we change. However, we are raised differently in how to handle money and this often causes challenges in relationship.

Money management in relationships does not simply mean paying the bills. How each person in the relationships manage their daily to urgent spending could create conflict and break the trust they have for their partner. Open communication is key to success in Love, Money, and Relationships.

6. What advice can he give someone looking for love in 2022?

Open your eyes before opening your heart. Love and Money are both important. When it comes to love, be forgiving and understanding of each other’s differences. When it comes to money, be attentive. You do not need to know how every nickel is spent. It is more efficient to manage money together if both of the parties understand each other’s intentions and habits in spending. In short, be willing to have open and contributive dialogue, set your boundaries with love and love with a clear intention.

Thank you for reading our blog. If you would like to reach out to Axis, you can check out his company’s website at www.axisvero.com.

Team Jackie Porter is happy to help you build your financial confidence and manage your wealth more sustainably with your loved ones. Hit us up at info@askjackie.ca for a free 30 minute session on financial literacy.

More Financial News & Events

Learn Hacks to Help You Build Your Wealth!

Aug

Video – Learn About Regulatory Compliance and Operations with Parthik Mehta!

Jun

BTS with the Sales and Administrative Department at TJP!

Jun

Video – Get to Know Jin Lee, one of TJP’s Financial Planners!

Jun

Video – What Does Financial Happiness Mean for Business Owners_

Jun

Video – How Do Retirees Define Financial Happiness & Habits to Maximize Their Finances

May

Conquer Tax Season With the Right Bookkeeper!

May

Video – How Does Money Tie Into Personal Happiness

May

Video – What Can You Do to Cultivate Your Financial Freedom

May

Exploring Financial and Emotional Resilience

Mindshift Mastery and Emotional Resilience

Creating a mentor mindset: How to become one or find one

Jan

Legal Financial Fitness: A Comprehensive Checklist for Thriving Practices

Jan

How to Mentally and Financially Prepare for a Layoff

Jan

2023 tax considerations you may have missed

Dec

How to Hold on to More of Your Cash this Holiday Season

Dec

Financial Moves to Make Before Year End

Dec

Navigating Stagflation: Financial Resilience in Uncertain Times

Nov

Buying and selling real estate amidst inflation

Nov

Navigating the Changing Tides: Real Estate, Inflation, and Rising Mortgage Rates

Nov

How does inflation affect your financial plan?

Nov

Caring for aging parents: The journey and lessons learned along the way

Oct

Resources For managing care for Aging Parents

Oct

Talking to Aging Parents About Finances

Oct

Living your best life: Infusing your best life into your your everyday

Oct

Living your best life: Striking the balance between enjoying life now or enjoying it later

Sep

Living Your Best Life: Client Testimonials and Insights

Sep

Unpacking FOMO: Understanding biases, emotions and financial attitudes

Aug

How to overcome FOMO to not overspend this summer

Aug

How to Overcome FOMO on Investments

Aug

What behaviours undermine your ability to build wealth

Jul

How Do You Loose Wealth

Jul

What Does Wealth Building Mean to Our Clients?

Jul

Estate Planning: What You Can Learn From the Mistakes of Celebrities

Jun

Estate Planning For Lawyers

Jun

Estate Planning for Business Owners

Jun

Managing growth for business owners

May

Are you a lawyer with questions on how to grow your investments?

May

Cultivating a growth mindset around money

May

Why financial growth can be deceptive

May

Home and Financial Document Organization

Apr

Business owners, it’s time to start spring cleaning.

Apr

Spring Cleaning Your Finances

Apr

Unique financial challenges female lawyers face

Mar

Taking Action: A Woman’s Perspective on Deciding To Tackle Her Finances

Mar

Is there a gap in your income protection?

Mar

Knowing the difference between Tax Filer and Tax Advisor

Mar

Conquering Women’s Fears Around Finances

Mar

Trends in Family Law

Feb

PART 2: Financial Conversations Couples Need To Have at Different Life Stages

Feb